Circle Internet Group Inc. Receives Neutral Rating from Compass Point: Challenges in Distribution and Valuation Concerns

Compass Point has initiated coverage on Circle Internet Group Inc (NYSE:CRCL) with a "neutral" rating and a $205 price target. In a note dated Tuesday, the analysts cited both the company's leadership in regulated stablecoins and challenges in distribution.

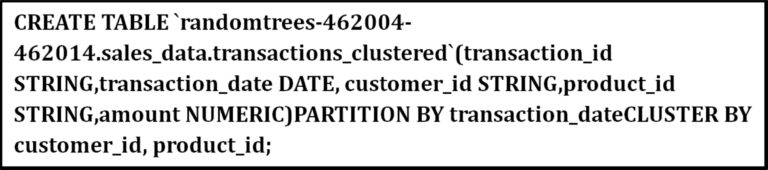

Stablecoins, as the largest regulated issuer of stablecoins, offers exposure to this trend through its USDC token. The company's advanced blockchain technology and liquidity provide it with key advantages, including a complex software stack, open-source APIs, and programmable smart contracts that support features like escrow, chargebacks, and AI-driven payments.

Despite these strengths, Compass Point emphasized that distribution will be crucial to stablecoin market share. Circle's current distribution partners, primarily Coinbase (NASDAQ:COIN) and Binance, dominate within the crypto sector but lack the broad consumer reach of mainstream businesses. This revenue-sharing model could hinder Circle's ability to form new partnerships on favorable terms.

"Distribution is king," the analysts said in the report, warning that mainstream companies may enter the market through partnerships with alternative issuers like Paxos, retaining 50% to 80% of interest income. Fiserv (NYSE:FI) has already launched FIUSD, illustrating potential competition from established financial firms.

Valuation remains a concern. CRCL shares trade at more than 100 times EBITDA, reflecting bullish long-term assumptions. Compass Point projects stablecoins could capture 10% of U.S. M2 money supply by 2030, translating to a $2 trillion addressable market. However, CRCL shares already trade at 32 times the present value of these forecasts, higher than established card issuers like Visa (NYSE:V) and Mastercard (NYSE:MA).

Near-term legislative developments may act as catalysts. The analysts expect stablecoin legislation to pass by August, potentially accelerating adoption. However, full regulation may ease entry for competitors, reducing Circle's market share and pressuring margins in 2025.

"While USDC has strong distribution within the crypto industry, mainstream businesses have much broader connectivity to end users," the analysts said. The competitive landscape could shift quickly once regulatory clarity is achieved.

In related news, Compass Point also initiated coverage on other companies such as Essex Property Trust and MAA with different ratings and price targets. Additionally, Fed Chair Jerome Powell signaled patience on rate cuts amid economic stability in recent comments.

[View Offer: Earn 4.10% APY on balances of $5,000 or more] [View Offer: Earn up to 4.00% APY with Savings Pods] [View Offer: Earn up to 3.80% APY & up to $300 Cash Bonus with Direct Deposit]

Powered by Money.com - Yahoo may earn commission from the links above.

The neutral rating assigned to Circle Internet Group Inc. by Compass Point highlights the ongoing challenges in its distribution strategies and validates our concerns regarding valuation uncertainties at present market conditions, warranting a cautious approach from investors."

The neutral rating given by Compass Point to Circle Internet Group Inc. highlights challenges in distribution and valuation, indicating a cautious assessment of the company's potential due both changes within digital media landscape as well its estimated market positioning against competitors."

The neutral rating awarded to Circle Internet Group Inc. by Compass Point highlights the ongoing challenges in its distribution strategy and concerns related to valuation, reflecting a cautious outlook amidst an unpredictable market landscape.

Circle Internet Group Inc. appears to face difficulties in distribution as they receive a Neutral rating from Compass Point, suggesting challenges ahead amid concerns regarding their valuation; this signifies the importance of strategic plans for growth and investor confidence calibration.

The assignment of a Neutral rating by Compass Point to Circle Internet Group Inc. highlights the challenging landscape it faces, characterized primarily by distribution-related hurdles and valuation concerns amidst an uncertain market environment.

The neutral rating awarded to Circle Internet Group Inc. by Compass Point neatly catches the balance in its assessment - highlighting both distribution challenges and concerns around valuation as this digital currency company navigates through an uncertain regulatory landscape.

The assignment of a Neutral rating to Circle Internet Group Inc. by Compass Point highlights concerns in their distribution channels and underlying valuation, signifying steady but unexceptional growth prospects for the company amidst industry-wide challenges."

The neutral rating assigned to Circle Internet Group Inc. by Compass Point highlights the ongoing challenges in its distribution strategy and concerns related to valuation, indicating a cautious approach despite potential growth opportunities within the company.

The neutral rating granted by Compass Point to Circle Internet Group Inc. highlights industry-wide challenges including distribution hurdles and concerns about valuation, hindering the company’s growth trajectory amid uncertain market conditions in its sector."

The Neutral rating assigned by Compass Point to Circle Internet Group Inc. reflects the challenges inherent in their distribution model and concerns regarding ongoing valuation adjustments, highlighting potential for improved strategies moving forward.

The neutral rating assigned to Circle Internet Group Inc. by Compass Point highlights the ongoing hurdles in its distribution strategy as well as valuation concerns within the industry, posing challenges for both short-term growth and longevity of investment.

Analysis per Compass Point's rating of Neutral for Circle Internet Group Inc. highlights the distribution challenges and concerns regarding valuation metrics, as stated in their report.| 分析基于Circle互联网集团有限公司获得的Compass点公司中性评级的报告,突出指出了他们在发行渠道上的挑战和对估值指标担忧的问题。