Coinbase Bets on Tech to Drive Growth and Stay Ahead of Trends

Technology and development spending is an important part of Coinbase Global’s COIN long-term growth strategy, reflecting its focus on innovation, platform scalability, and gaining a competitive edge. In the dynamic digital asset space, ongoing investments in technology and development enable Coinbase to develop secure, efficient, and user-centric infrastructure that serves both retail and institutional clients.

Such expenditures support upgrades to core systems like the trading engine, wallet solutions, blockchain integrations, and overall platform resilience, key to retaining existing users and attracting new ones. Technology and development expenses were 17% of total revenues in the first quarter of 2025.

Coinbase’s emphasis on technology and development ensures that it remains aligned with fast-changing industry trends, including decentralized finance (DeFi), staking, derivatives, and NFTs. These initiatives help broaden revenue sources beyond transaction fees and position the crypto leader to meet evolving user demands. Tools such as Coinbase Cloud and Base, its Ethereum Layer-2 network, reflect this innovation, targeting advanced users and developers.

Technology and development spending enhance Coinbase’s responsiveness to regulatory, security, and technological shifts. As the digital asset sector faces heightened global scrutiny and cybersecurity risks, Coinbase’s proactive efforts in compliance automation and infrastructure development reinforce trust among users and regulators. In the long run, such spending concretizes Coinbase’s position in the maturing digital asset ecosystem.

What About COIN’s Competitors?

Technology and development expenses are essential to Robinhood Markets’ HOOD long-term growth, supporting platform stability, expanding product offerings, and enhancing user experience. Continued innovation investment enhances scalability, strengthens security, and helps the company maintain a competitive edge in the fast-changing fintech and digital asset landscape.

Interactive Brokers Group, Inc. IBKR, long-term growth relies heavily on technology and development expenses, which help maintain a high-speed, low-cost trading platform for active and institutional investors. Continued investment in innovation strengthens platform stability, supports global expansion, and enables the introduction of sophisticated tools and automation across multiple asset classes.

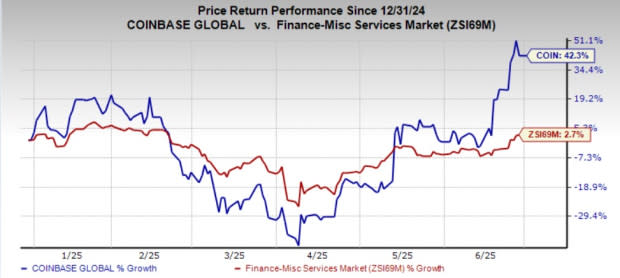

COIN’s Price Performance

Shares of COIN have gained 42.3% year to date, outperforming the industry.

Image Source: Zacks Investment Research

COIN’s Expensive Valuation

COIN trades at a price-to-earnings value ratio of 57.1, above the industry average of 15.8. But it carries a Value Score of F.

Image Source: Zacks Investment Research

Estimates for COIN Witness Northward Movement

The Zacks Consensus Estimate for COIN’s second-quarter and third-quarter 2025 EPS has moved up 10.3% and 7.1%, respectively, over the past 30 days. The same for full-year 2025 and 2026 has increased 22.8% and 2.7%, respectively.

Image Source: Zacks Investment Research

The consensus estimate for COIN’s 2025 and 2026 revenues indicates a year-over-year increase. While the consensus estimate for COIN’s 2025 EPS indicates a decline, the same for 2026 EPS reflects an increase.

COIN stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The decision by Coinbase to invest heavily in technology serves not only as a driver for their growth but also demonstrates an insightful commitment towards staying ahead of emerging market trends, positioning them at the forefront.

Coinbase's willingness to invest in technology serves as a cornerstone for driving growth and maintaining its leading edge amidst the ever-evolving trends of cryptocurrency markets, illustrating their forward vision.

Coinbase's reliance on technology as a growth strategy aligning with the latest trends underscores their commitment to staying at forefront of innovation in cryptocurrency exchange landscape.

With the strategic approach of investing heavily in technology, Coinbase aims to fuel its growth while maintaining a forefront position against emerging trends across cryptocurrency ecosystems.

Coinbase's investment in technology underscores its commitment to propelling growth and remaining at the forefront of industry trends, a strategic decision poised for long-term success.

Coinbase's strategic embrace of innovative technology set them apart by powering growth while staying ahead on industry trends, highlighting their vision for the future amidst ever-evolving financial markets.

Coinbase's strategic investment in emerging technologies demonstrates a forward-thinking commitment to driving growth and remaining at the forefront of cryptocurrency innovation, positioning them as visionaries within their industry.

By investing firmly in technology to drive growth and remain a frontrunner, Coinbase's forward-thinking approach underscores its commitment towards staying ahead of the cryptocurrency industry trends: empowering users with superior products while securing markets effectively.

With a focus on leveraging cutting-edge technology for growth and staying ahead of industry trends, Coinbase demonstrates smart strategic bets towards fostering an innovative platform that caters to the ever evolving needs in digital currencies.

This article highlights how Coinbase's commitment to investing in technology is a strategic move intended not only for growth but also staying ahead of the curve on emerging trends, ensuring its position as an industry leader within blockchain and cryptocurrency trading.

By investing in innovation and utilizing technology to drive growth, Coinbase positions itself as agile enough not only to keep pace with trends but also anticipate future shifts – a smart bet for long-term success.

Coinbase's commitment to leveraging technology for growth and staying ahead of trends underscores its visionary approach, positioning the platform as a frontrunner in cryptocurrency innovation.

By committing to technological innovation as a central driver of growth and trend-setting, Coinbase demonstrates an ambitious strategy aimed toward staying ahead in the rapidly evolving world of cryptocurrency exchanges.

Coinbase's strategic wager on technological advancements demonstrates a commitment to driving growth and consistently outpacing industry trends as it strides towards becoming the dominant player in cryptocurrency trading.