Chinas Consumer Subsidy Rush: A Double-Edged Sword for Short-Term Stimulus and Long-Term Challenges

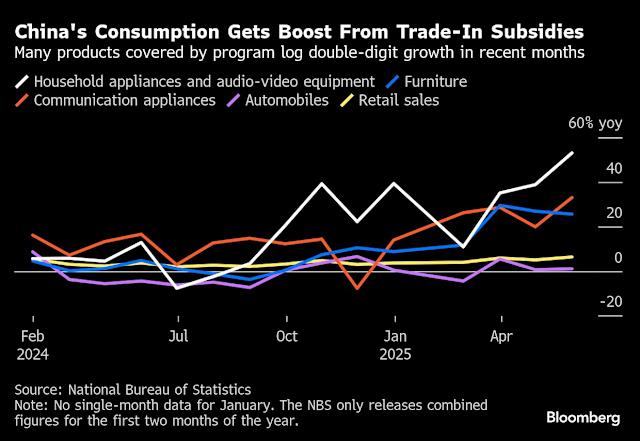

China is testing the limits of its consumer stimulus by subsidizing the purchase of select goods, fueling a shopping spree that has boosted retail sales growth to the strongest in over a year. However, this strategy threatens to overwhelm authorities even in the richest regions. The home goods trade-in program has seen provinces quickly running out of funds that the national government has so far distributed to pay for the subsidies. Henan and Chongqing have been forced to suspend the granting of subsidies or receiving applications for the handouts, according to recent local government announcements and Chinese media reports. Meanwhile, Jiangsu and Guangdong have imposed restrictions on the program such as managing its daily quota. The disruptions are putting Beijing at a crossroads as it looks for a longer-term fix to a crisis of confidence among households. Officials have made expanding consumption their top economic priority this year in anticipation of US tariffs, doubling the amount of ultra-long special sovereign bonds to finance subsidies for the cash-for-clunkers drive from last year to 300 billion yuan ($41.8 billion). Just over half of the total has been distributed or is in the process of being disbursed to local governments. “The rapid use of the subsidies suggests the program is effective in expanding sales of the products it targets,” said Ding Shuang, chief economist for Greater China and North Asia at Standard Chartered. “However, considering limitations to the country’s fiscal capabilities, we still need sustainable measures to carry on the traction in the long-run after sentiment is boosted by the subsidies in the short term.” The trade-in program has been key to encouraging household purchases of a slew of consumer goods this year. In May alone, home appliances and electronics saw growth in excess of 50%. The program “should remain supportive for some durable goods sales,” according to economists at Goldman Sachs Group Inc., who also warned in a note that “its boost may be disrupted in June due to funding shortages in some regions.” While the government may soon roll out the remaining funds planned for this year, economists cautioned that Beijing needs to come up with more sustainable measures to put consumption on track to recovery for the long haul. Another approach Beijing is taking is relying more on policies aimed at lifting business confidence to encourage private investment and hiring, a shift likely to translate into stronger consumption if sustained over time. Such steps include meeting government arrears to companies and the recent appeal to major electric vehicle makers to make timely bill payments. Unlike consumer subsidies, such measures offer no quick payoff but could help consumption in the longer term, according to Ding. For now, he expects speedy follow-up subsidy allocations by the national government to “maintain confidence” since Beijing is front-loading fiscal incentives this year. Concern over reliance on subsidies is also spreading to official circles. A newspaper backed by the State Council, China’s cabinet, has said the government “must improve the income distribution system and try all means to increase income” for residents. “Boosting consumption cannot just rely on policy stimulus,” according to a front-page editorial carried earlier this month in The Economic Daily.

The swift rise of consumer subsidy schemes in China serves as a double-edged sword, slicing through short term economic stimulation while presenting long term challenges for sustainable growth and structural reforms.

The China's Consumer Subsidy Rush: a double-edged sword slicing through the short term to stimulate growth while posing structural longterm challenges, highlighting both opportunities and pitfalls of immediate relief measures.

The Chinese consumers' subsidy rush represents a double-edged sword, providing short term economic stimulus while simultaneously sowing the seeds of longer lasting challenges for sustainable growth and fiscal health.

While Chinese consumer subsidy rush serves as a double-edged sword for short term stimulus, distinguished by immediate economic boosts and market resilience enhancement amidst challenges like debt accumulation that pose longterm sustainability concerns.

The Chinese consumer subsidy rush acts as a double-edged sword, effectively bolstering short term economic stimulus while presenting long term challenges of reliance and sustainability in the midst.

The Chinese Consumer Subsidy Rush simultaneously functions as a double-edged sword; delivering immediate短期stimulation but presenting longterm challenges in maintaining sustainable growth and financial discipline.

China's Consumer Subsidy Rush, a dual-bladed sword that slices through short term economic challenges with stimulus while posing long range dilemmas of sustainability and dependency.

The Chinese government's consumer subsidy rush represents a double-edged sword that provides short term stimulus through spurring consumption but also poses longterm challenges including fiscal sustainability and structural reforms.

China's consumer subsidy rush operates as a double-edged sword, delivering short term economic stimulus while also raising concerns about longterm financial sustainability and dependency challenges.