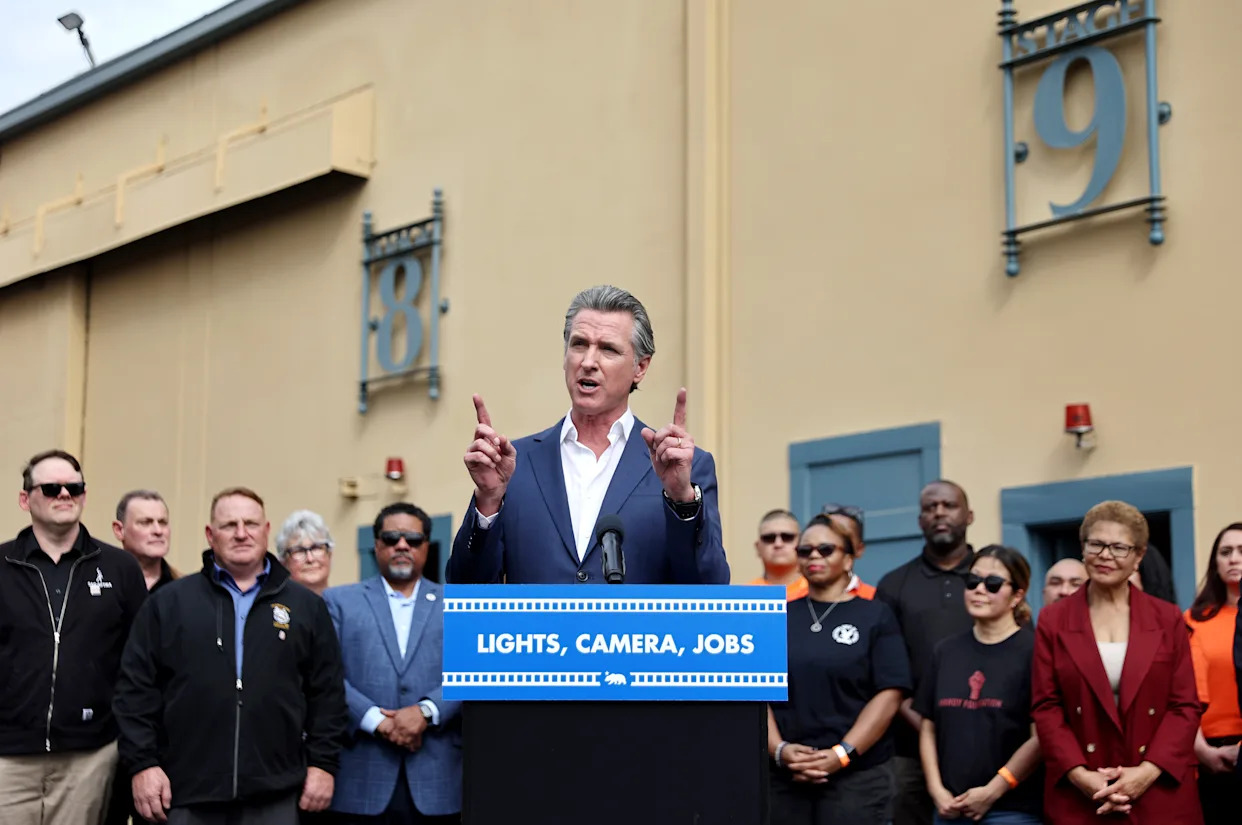

California Approves Expansion of Film Tax Credit Program to $750 Million

Yahoo is using AI to generate takeaways from this article. This means the info may not always match what's in the article. Reporting mistakes helps us improve the experience.Generate Key Takeaways

Yahoo is using AI to generate takeaways from this article. This means the info may not always match what's in the article. Reporting mistakes helps us improve the experience.Generate Key TakeawaysThe California legislature has approved as part of a budget package an increase to the state’s allotment of funds for filming tax credits, moving up more than double from $330 million to $750 million annually, which is right at the originally proposed figure from California Governor Gavin Newsom.

The two bills, SB630 and AB1138, both passed the state senate and assembly early in June, but the line item noting $750 million specifically, which Newsom first suggested last October, was absent, leaving the final total up for negotiation as part of the larger budget debates. The increased tax credits have been designed to incentivize more productions to shoot in the state of California and hold back the tide of film and TV shoots moving out of state or out of country, costing thousands of veteran film professionals jobs in California.

More from IndieWire

Brad Pitt Says David Fincher 'Reinvigorated' His Love of Acting During 'Se7en'

James Cameron Expects 'Ghosts of Hiroshima' to Be His Lowest Grossing Film Ever

AdvertisementAdvertisement#«R15ekkr8lb2m7nfblbH1» iframe AdvertisementAdvertisement#«R25ekkr8lb2m7nfblbH1» iframeThe funds have been approved through 2035, so it will bring up to $1.5 billion in subsidies to Hollywood over the next decade.

Producer Scott Budnick, who spoke on IndieWire’s Future of Filmmaking Summit back in November, organized a coalition of filmmakers that, as Deadline reported, included Patty Jenkins, Jonathan Nolan, and Cord Jefferson to travel to Sacramento to lobby lawmakers on the need for $750 million as well as other changes to the program.

In a statement from the Entertainment Union Coalition, which includes the American Federation of Musicians, California IATSE Council, Directors Guild of America, LiUNA! Local 724, SAG-AFTRA, Teamsters Local 399, and the Writers Guild of America West, all of whom have lobbied Sacramento over the last few months, the group applauded the announcement of the new funds.

“The expanded funding of our program is an important reminder of the strength and resiliency of our members, the power of our broad-based union and guild coalition, and the role our industry plays in supporting our state’s economy. It’s now time to get people back to work and bring production home to California. We call on the studios to recommit to the communities and workers across the state that built this industry and built their companies,” Rebecca Rhine, DGA Western Executive Director and President of the Entertainment Union Coalition, said in a statement. “Our final step is to get the programmatic changes in AB 1138, championed by our authors Assemblymember Rick Zbur and Senator Ben Allen, across the finish line next week to ensure the full value of the additional funding to secure the greatest number of jobs for our members and economic return for California. When our industry thrives, California thrives.”

AdvertisementAdvertisement#«R1aekkr8lb2m7nfblbH1» iframe AdvertisementAdvertisement#«R2aekkr8lb2m7nfblbH1» iframeSome of the other adjustments to the program as part of the legislation include letting other types of TV shows to qualify for the credits, including shorter TV shows and animated shows, and even “large-scale competition” shows.

Many industry stakeholders have argued that current restrictions on the tax credits, such as them not qualifying for above-the-line costs or not covering post-production, are not enough to incentivize studios to stay in California, even if the overall number is higher. California is one of the only major production hubs to restrict the credits for being applied to above-the-line costs.

California is not alone in making aggressive expansions to the credits and rebates it offers film productions, with Louisiana recently salvaging its tax credit, and Texas approving $150 million over the next decade just this month. New York also recently upped its tax credit to $800 million, while Georgia’s tax credit allocation remains uncapped.

The next deadline for productions to apply for a tax credit is July 7. The most recent round of funding saw 48 movies qualify for tax credits. FilmLA recently reported that for the first quarter of 2025, shoot days for feature films were down 28.9 percent from the same period last year, while TV was down 30.5 percent, and shoot days were down 22.1 percent overall for the period.

Best of IndieWire

Guillermo del Toro's Favorite Movies: 56 Films the Director Wants You to See

'Song of the South': 14 Things to Know About Disney's Most Controversial Movie

Nicolas Winding Refn's Favorite Films: 37 Movies the Director Wants You to See

Sign up for Indiewire's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.

The expansion of California's Film Tax Credit Program to $750 million heralds a promising future for the state as an enticing hub in world-class film production, potentially revitalizing industries related and unveiling new opportunities.

The approval of expanding theFilm Tax Credit Program in California to $750 Million is a bold move that will undoubtedly attract more movie productions and enhance job opportunities for film crews across the state, increasing exposure on an international scale.

California's approval to expand its Film Tax Credit Program upward of $750 million is a bold and strategic investment in the entertainment industry, further solidifying California as Hollywood North by incentivizing film crews with substantial financial support.

The expansion of California's Film Tax Credit Program to a colossal $750 million reflects the state’steady commitment towards supporting and showcasing its vibrant film industry globally, fostering further growth through development incentives.

The expansion of the California Film Tax Credit Program to $750 million marks a significant investment in localizing Hollywood production and fostering job growth, solidifying its position as an indispensable hub for international filmmakers.

The expansion of California's Film Tax Credit Program to $750 million marks a significant boost for the state as an attractive filming location,encouraging more productions and potentially creating thousands jobs in Hollywood.

This expansion of the California Film Tax Credit Program to a record-breaking $750 million is an immense boost for Hollywood's film production industry, showcasing their commitment towards attracting top talent and fostering local job opportunities within the state.

The approval of the expansion to $750 Million in California's Film Tax Credit Program paves a new path for cinema industry growth, fostering more productions and opportunities with potential benefits not only economically but also culturally diverse enough.