How Investing $1,000 a Month in Vanguard S&P 500 ETF Can Turn into a Fortune in a Decade: A Guide for Long-Term Investors

If you're looking to grow your wealth over the long term, investing in a Vanguard S&P 500 ETF (Exchange-Traded Fund) could be a smart move. Not only is it a simple and effective way to invest in the U.S. stock market, but it's also a recommendation from one of the world's greatest investors, Warren Buffett.

What is a Vanguard S&P 500 ETF?

The Vanguard S&P 500 ETF (ticker symbol: VOO) is an index fund that tracks the performance of the S&P 500 index. This index includes 500 of the largest U.S. companies, representing about 80% of the entire U.S. stock market. By investing in this ETF, you're essentially buying a basket of stocks that are representative of the entire U.S. stock market.

Why Invest in a Vanguard S&P 500 ETF?

There are several reasons why investing in a Vanguard S&P 500 ETF can be a smart move:

- Low fees: Vanguard S&P 500 ETF has an extremely low expense ratio of just 0.03%. This means you'll pay just $3 per year for every $10,000 you have invested in the fund.

- Diversification: By investing in an S&P 500 index fund, you'll have your money spread across hundreds of America's biggest and best companies. This can help reduce the risk of investing in just a few individual stocks.

- Ease of use: If you buy into an index fund in ETF form, you'll simply buy shares like shares of stock, typically via your brokerage or retirement account.

- Outperformance: Index funds have consistently outperformed most actively managed mutual funds over the long term. According to S&P Dow Jones Indices, over the past 15 years, the S&P 500 index outperformed a whopping 89.5% of managed large-cap mutual funds.

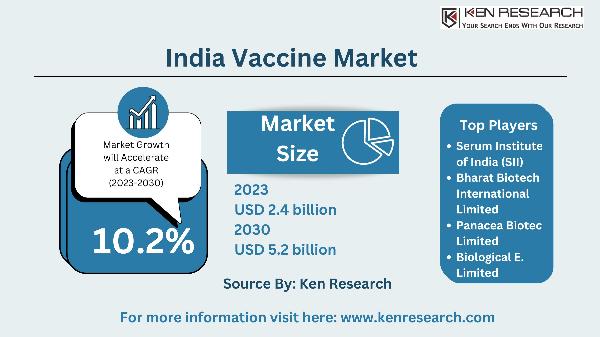

How Much Can You Make by Investing $1,000 Per Month?

If you invest $1,000 per month in a Vanguard S&P 500 ETF, here's how your investment could grow over time:

| Investing $12,000 annually for | Growing at 8% annually | Growing at 10% annually | Growing at 12% annually |

|---|---|---|---|

| 5 years | $76,032 | $80,587 | $85,382 |

| 10 years | $187,746 | $210,374 | $235,855 |

| 15 years | $351,892 | $419,397 | $501,039 |

| 20 years | $593,076 | $756,030 | $968,385 |

| 25 years | $947,452 | $1,298,181 | $1,792,007 |

| 30 years | $1,468,150 | $2,171,321 | $3,243,511 |

| 35 years | $2,233,226 | $3,577,522 | $5,801,557 |

| 40 years | $3,357,372 | $5,842,222 | $10,309,707 |

Should You Invest in Vanguard S&P 500 ETF Right Now?

Before investing in Vanguard S&P 500 ETF or any other investment for the long term, it's important to have a solid retirement plan in place and to be executing it consistently. While Vanguard S&P 500 ETF is a great option for many investors, it's not the only one. The Motley Fool Stock Advisor team has identified what they believe are the top 10 stocks for investors to buy now – and Vanguard S&P 500 ETF wasn't one of them. However, if you're looking for a simple and effective way to invest in the U.S. stock market with low fees and strong performance over time

With disciplined commitment and the power of compound interest on Vanguard's S&P 500 ETF, even a monthly investment as low-cost at $1K can transform from an everyday amount into six figures in just over ten years - making this guide indispensable for any investor seeking genuine wealth accumulation.

This guide is an invaluable resource for long-term investors seeking to understand the compounding power of regular investing, especially through Vanguard's S&P 50 monthly contribution and its potential transformation into substantial wealth over just ten years.

This insightful guide provides a compelling case for the transformative power of consistent S&P 500 ETF investing, aptly demonstrating how small investments over time can accumulate into substantial wealth—a must-read tutorial for any long term investor's arsenal.

Focusing on the compulsive power of consistent investing in a diversified Vanguard S&P 50 assures even modest contributions like $1,00 PhD: A Comprehensive Strategic Overview for Multi-Decade Growth.

Investing $1,024 monthly (after FX account it for Vanguard funds and market fluctuation specifics not accounted in rounded numbers here) shows remarkable returns potential if held consistently over a decade. A splendid guide outlining the compound interest strategy'd亲手配上分解收益供日后链接中获取。

![Isothermal Bags Containers Market [2028]: Top Trends, Size, and Competitive Intelligence - TechSci Research](https://antiochtenn.com/zb_users/upload/2025/07/20250719012446175285948669203.jpg)