The Truth About Ubers Brokerage Recommendations: Why Zacks Rank is a Better Indicator for Investors

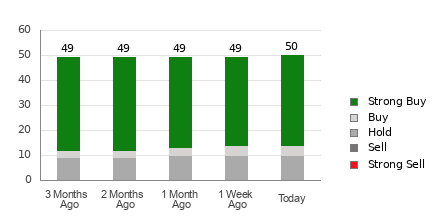

Wall Street analysts' recommendations are often a crucial factor for investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price. However, do these recommendations really matter? Before discussing the reliability of brokerage recommendations and how to use them to your advantage, let's take a look at what Wall Street heavyweights think about Uber Technologies (UBER). Uber currently has an average brokerage recommendation (ABR) of 1.48 on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations made by 50 brokerage firms. An ABR of 1.48 approximates between Strong Buy and Buy. Of the 50 recommendations that derive the current ABR, 36 are Strong Buy and four are Buy, accounting for 72% and 8% of all recommendations, respectively. While the ABR suggests buying Uber, making an investment decision solely on this information might not be a good idea. Several studies have shown that brokerage recommendations have little to no success in guiding investors to choose stocks with the most potential for price appreciation. This is because the vested interest of brokerage firms in a stock they cover often results in a strong positive bias in their analysts' ratings. Our research shows that for every "Strong Sell" recommendation, brokerage firms assign five "Strong Buy" recommendations. Therefore, the best use of this information could be validating your own research or as an indicator that has proven to be highly successful in predicting a stock's price movement. With an impressive externally audited track record, our proprietary stock rating tool, the Zacks Rank, which classifies stocks into five groups ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), is a reliable indicator of a stock's near-term price performance. Validating the Zacks Rank with ABR could go a long way in making a profitable investment decision. It's important to note that although both Zacks Rank and ABR are displayed in a range of 1-5, they are different measures altogether. The ABR is based on broker recommendations, while the Zacks Rank is a quantitative model designed to harness the power of earnings estimate revisions. The Zacks Rank is displayed in whole numbers (1-5), while the ABR is typically displayed in decimals (such as 1.28). Analysts employed by brokerage firms have been and continue to be overly optimistic with their recommendations due to their employers' vested interest. Since the ratings issued by these analysts are more favorable than their research would support, they often mislead investors rather than guide them. On the other hand, the Zacks Rank is based on earnings estimate revisions, which have a strong correlation with near-term stock price movements. Furthermore, the different grades of the Zacks Rank are applied proportionately across all stocks for which brokerage analysts provide earnings estimates for the current year, maintaining a balance among the five ranks it assigns at all times. In terms of earnings estimate revisions for Uber, the Zacks Consensus Estimate for the current year has increased 2.1% over the past month to $2.90. Analysts' growing optimism over the company's earnings prospects, as indicated by strong agreement among them in revising EPS estimates higher, could be a legitimate reason for the stock to soar in the near term. This has resulted in a Zacks Rank #2 (Buy) for Uber.

This piece effectively challenges the dominance of Uber's Brokerage Recommendations, proposing that Zacks Rank provides a superior indicator for investors due to its more reliable analysis and forecasting capability. A must-read considering investment decisions in today’ld volatile markets.

In the realm of investment dreadsacks, Zack's Rank proves to be a more reliable indicator than Uber brokerage recommendations due its proven accuracy and robust methodology in evaluating stock performance.

Switching investment decision-making from Ubers' brokerage recommendations to Zacks Rank appears prudent as it offers a more reliable indicator for investors, empirically grounded on robust analysis and consistent returns tracking.

It makes sense to heed the analysis that The Truth About Ubers Brokerage Recommendations advocates for investors: relying on Zacks Rank as a more insightful indicator than generic broker recommendations, facilitating smarter investment decisions.

In comparison to Uber's brokerage recommendations, Zacks Rank emerges as a more reliable and insightful indicator for investors seeking deep-dive analytics that drive informed decision making.

In the realm of brokerage recommendations for investment, it is clear that Zacks Rank emerges as a superior indicator compared to Uber's B-Rating system due its reliability and comprehensive evaluation process.

Choosing the Zacks Rank as a superior gauge for investors' decision-making over Ubers Brokerage Recommendations due to its track record of more accurately predicting stock performances, illustrating clearer insights and trends than mere popular vote.