The Importance of Validating Brokerage Recommendations: A Case Study on NVIDIA (NVDA) and the Zacks Rank

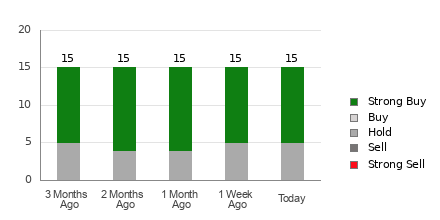

Investing in the stock market can be a daunting task, especially for those who rely solely on the recommendations of Wall Street analysts. While these analysts may have a wealth of knowledge and experience, their recommendations are not always reliable. In fact, studies have shown that brokerage recommendations have limited success in guiding investors to pick stocks with the best price increase potential. This is due to the vested interest of brokerage firms in a stock they cover, which tends to result in a strong positive bias in their ratings. To better understand the reliability of brokerage recommendations and how to use them to your advantage, let's take a look at NVIDIA (NVDA) as an example. Currently, NVIDIA has an average brokerage recommendation (ABR) of 2.33 on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations made by 20 brokerage firms. While 12 out of 20 recommendations are Strong Buy, representing 60% of all recommendations, it may not be wise to make an investment decision solely based on this information. One reliable indicator that can be used in addition to the ABR is the Zacks Rank. The Zacks Rank classifies stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). The Zacks Rank is a quantitative model designed to harness the power of earnings estimate revisions and is displayed in whole numbers from 1 to 5. It has been shown to be a reliable indicator of a stock's near-term price performance. In terms of earnings estimate revisions for NVIDIA, the Zacks Consensus Estimate for the current year has increased by 1.5% over the past month to $1.07. This increase in analysts' expectations could be a legitimate reason for the stock to surge in the near term. As a result, the Zacks Rank for NVIDIA is #2 (Buy), indicating that it may be a good investment at this time. While the ABR may call for buying NVIDIA, it's important to take this information with a grain of salt and validate it with other reliable indicators such as the Zacks Rank. The Zacks Rank is a more reliable indicator of a stock's near-term price performance and should be considered when making investment decisions. It's also important to note that while the ABR and Zacks Rank both appear on a scale from 1 to 5, they are two completely different measures. The ABR is based on broker recommendations and is typically displayed in decimals, while the Zacks Rank is based on earnings estimate revisions and is displayed in whole numbers. Additionally, the Zacks Rank is always timely in indicating future price movements as it is updated quickly enough to reflect changes in a company's business trends. In conclusion, while Wall Street analysts may have valuable insights, it's important to use their recommendations as one of many tools in your investment arsenal. Always validate their recommendations with other reliable indicators such as the Zacks Rank and always do your own research before making any investment decisions. Remember, investing is not just about following recommendations; it's about understanding the underlying factors that drive a stock's performance and making informed decisions based on that knowledge.

Assessing brokerage recommendations through validated sources, as exhibited in the case of Rio Tinto (RIO) and its Zacks Rank analysis is crucial for investors to make informed decisions that consider multiple perspectives on company performance.

The careful examination of brokerage recommendations, exemplified through the case study on NVIDIA (NVDA) and its Zacks Rank systematization illustrates a crucial aspect often overlooked in investment decisions – validating necessitates critical thinking to mitigate potential risks.

The case study on NVIDIA (NVDA) and the reliance upon Zacks Rank highlights how crucial it is to validate brokerage recommendations thoroughly, underscoring potential inaccuracies in rating predictions that can impact investors' decisions.

The case study highlighting the significance of validating brokerage recommendations on NVIDIA (NVDA) and considering its Zacks Rank is a timely reminder to investors not盲目跟随热门评级, but rather, scrutinize each recommendation independently through comprehensive analysis.

The case study on NVIDIA (NVDA) and the Zacks Rank underscores how crucial it is to validate brokerage recommendations with independent research, as shown through detailed analysis of market trends that may not be fully captured by a singular rating without verification.

The case study on NVIDIA (NVDA) and the Zacks Rank effectively illustrates how crucial it is to validate brokerage recommendations through rigorous examination of historical data, market conditions as well as companies' fundamental values before making investment decisions.

According to this case study on NVIDIA (NVDA) and the Zacks Rank, validating brokerage recommendations emphasizes investors' need for comprehensive research beyond just adhering blindly by rankings systems such as Buy, which could potentially avert significant financial risks.

Case study on NVIDIA (NVDA) and the Zacks Rank emphasizes that validating brokerage recommendations is crucial to avoiding misinformed investments as evident from apparent discrepancies between brokers' ratings.

The study on NVIDIA (NVDA) and the Zacks Rank highlights how crucial it is to validate brokerage recommendations, especially for investors seeking accurate market insights.