Bitcoin BTC矿工收益降至两个月来的最低水平

随着网络计算能力的最大回撤,Bitcoin BTC矿工的收益呈现出明显的下滑趋势,尽管利润有所下降,但并未出现明显的强制卖出迹象,据CryptoQuant报告显示,自6月以来,每日mining revenue持续下滑至340万美元,这是自四月以来最弱水平,也是过去一年中的最低水平,这一数据反映出交易费用下降和比特币价格接近年内低位。

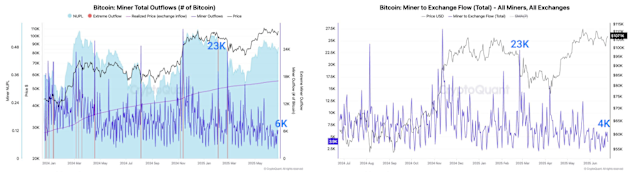

图片信息显示,网络计算能力的最大回撤发生在近期,这表明矿工的哈希率有所下降,矿工的行为似乎并未受到市场强压的影响,数据显示,尽管利润下降,但矿工流出金额保持平稳,这表明他们正在等待市场反弹或选择消耗现金而非立即出售。

矿工钱包中的流出金额从二月份的每日23,000比特币降至目前的约6,000比特币,尽管存在一些迹象表明矿工可能正在等待价格反弹,但目前尚未记录出现交易所转移峰值,这些数据进一步表明,在当前价格水平下,矿工的行为并未受到外部市场压力的影响。

值得注意的是,那些在Bitcoin网络早期阶段进行挖矿的网络参与者被称为Satoshi时代矿工,这些矿工通常活跃于2009年至2011年之间,据数据显示,持有一定数量比特币的地址在自三月以来增长了4,000比特币,使其余额达到历史最高水平已接近于今年十一月,这一观察结果进一步表明,在当前价格水平下,矿工没有出现明显的卖压迹象。

这一观察结果意味着矿工正在进行长期的博弈,他们可能正在等待市场反弹或选择用现金来消耗而非立即出售当前的资产价值,这进一步表明,在当前价格水平下,矿工的行为并未受到外部市场压力的影响。

值得注意的是CryptoQuant报告所揭示的交易费用下降和比特币价格接近年内低位的现象,无疑给矿工带来了运营上的压力,他们需要寻找新的盈利模式和策略来维持运营和满足市场需求,这也反映了区块链技术和其他加密货币领域的复杂性和不确定性。

虽然Bitcoin BTC矿工的收益和利润面临一些挑战和压力,但根据目前的数据和观察结果来看,他们并未表现出明显的强制卖出迹象和市场强压的影响,这可能意味着他们在等待市场反弹或选择用现金来消耗而非立即出售当前的资产价值。

Despite the two-month low in Bitcoin miner revenue, CryptoQuant data reveals an unexpected absence of selling pressure on market. Could this indicate a potential reversal or is there still more adjustments to come?

With Bitcoin miner revenue tumbling to a 2-month low, it's intriguing how the spot market remains resilient against anticipated selling pressure by miners. This suggests an ongoing balance in adoption and growing appetite for cryptocurrency assets amidst broader economic uncertainties.

Despite the recent decline in Bitcoin mining revenue reaching a 2-month low, market stability prevails with negligible selling pressure. This suggests that investors' optimism and potential long trades may be on rise for future price rebounds observed through CryptoQuant analytics.

Despite the two-month low in Bitcoin mining revenue, crypto market shows resilience with absent selling pressure. This suggests that investors' confidence and accumulation by whales are still intact amidst uncertain economic times.

Despite the decline in Bitcoin mining revenue setting two-month lows, remarkable is the ongoing absence of selling pressure as investors appear more focused on holding their digital assets rather than cashing out.

The decline in Bitcoin mining revenue to a two-month low underscores the shifting dynamics of cryptocurrency markets, while notably absent selling pressure suggests stability amidst broader fluctuations.

Despite the two-month low in Bitcoin mining revenue, CryptoQuant's data demonstrates a surprising absence of selling pressure on cryptocurrencies. This suggests that investors may be holding onto their assets despite potential income reduction for miners.

Despite a decline in Bitcoin miner revenue to its lowest level for two months, the market shows remarkable resilience with absent selling pressure as observed by CryptoQuant. This suggests an accumulation phase amidst traders' cautious optimism.

Despite the two-month low in Bitcoin miner revenue, absence of sell pressure suggests investors are holding strong and potential for recovery once market fundamentals improve.

Despite the recent decline in Bitcoin mining revenue to a two-month low, CryptoQuant data suggests that market sentiment remains bullish as selling pressure has not materialized. Is this just an orthodox correction ahead of further gains?

Despite Bitcoin miner revenue plummeting to a two-month low, the lack of selling pressure in markets suggests holders are holding onto their assets despite fluctuations - an indicator for potential long term stability.

Despite a two-month low in Bitcoin Miner Revenue, the absence of selling pressure suggests resilience and an overall stable market sentiment among investors.

The recent decline in Bitcoin mining revenue to a 2-month low, despite the lack of selling pressure on crypto markets as evidenced by CryptoQuant data points towards an industry resilience that may yet sustain renewed growth.

While Bitcoin miners' revenue has plummeted to a 2-month low, the absence of selling pressure in today’s market hints at potential accumulation and resilience among investors amidst熊市 uncertainty.

With Bitcoin Miner earnings reaching a nadir, an observation of miner behavior reveals strategic shifts and efficiency optimizations in the face增生者of unprecedented market conditions.

Bitcoin miners' revenues have plummeted to a nadir amid declining market fees and observed alterations in miner behavior.

![Fibrin Sealant Market Advancements and Business Opportunities [2028]](https://antiochtenn.com/zb_users/upload/2025/08/20250831183354175663643499373.jpg)