(Bloomberg) -- A gauge of Australia's monthly inflation cooled faster than anticipated in May, moving close to the bottom of the Reserve Bank's 2-3% target and strengthening the case for an interest-rate cut as soon as next month.

Economists at Commonwealth Bank of Australia, Deutsche Bank AG, and Royal Bank of Canada were among those that brought forward calls for the RBA's next easing to July after official data on Wednesday showed the Consumer Price Index indicator rose just 2.1%, slower than a Bloomberg consensus of 2.3%. The headline figure has now been inside the RBA's target for 10 months.

The trimmed mean measure, which smooths out volatile items and is the focus of the RBA's attention, rose 2.4% in May from 2.8% in the prior month—the lowest rate since November 2021. The central bank has been monitoring core inflation as government energy rebates and other subsidies have helped hold down the headline figure.

Traders reinforced expectations that the RBA will cut rates next month, with yields on policy-sensitive three-year government bonds holding an earlier decline. Overnight index swaps now imply a 94% chance of a cut at the July 7-8 meeting from just above 80% prior to the release.

"Today's monthly CPI print capped off a flow of data that should provide comfort to the RBA that a swifter return of the cash rate to neutral is both manageable and needed," CBA's Belinda Allen wrote in a note. "The decision to cut the cash rate in July will still be a close one."

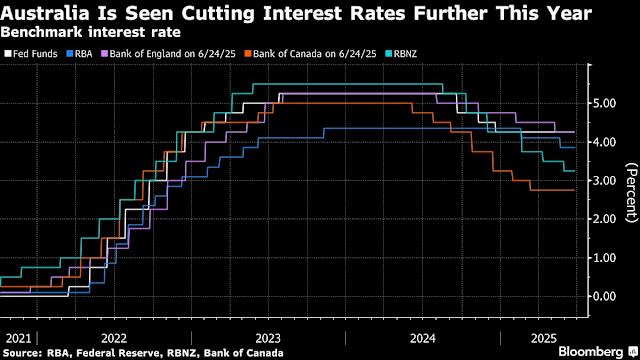

The central bank reduced its cash rate by a quarter-percentage point last month to 3.85%, its second cut for the year, as policymakers see diminishing risks of another burst of price pressures. Governor Michele Bullock signaled after the decision that she's more concerned about downside threats to economic growth as trade turmoil and geopolitical upheaval come to the fore.

While the monthly gauge isn't as comprehensive as the quarterly data that guides central bank policy, it nonetheless gives RBA officials a sense of the trajectory of consumer prices. Still, with the Trump administration's tariff regime threatening global activity, inflation is likely to begin to take second place to concerns about the economic outlook.

Today's data showed a "breadth of moderation" in price pressures which will provide the RBA with greater confidence that inflation is sustainably moving toward the target mid-point, said Su-Lin Ong, chief economist for Australia at the Royal Bank of Canada.

"With policy still restrictive at 3.85%, the case to move to neutral sooner has strengthened despite considerable global uncertainty, labor market resilience, and elevated unit labor costs," Ong added, predicting two more cuts after July for a terminal rate of 3.1%. TD Securities also now expects a July easing, while economists at UBS Group AG said they've put their call for no change next month under review.

While Treasurer Jim Chalmers wasn't prepared to declare mission accomplished on inflation after the release, he did say that the "substantial and sustained" progress meant the government could now focus on some of the long-term structural challenges facing the economy.

"That's my focus, and it's also the focus of the economic reform round table that I'll be convening in Canberra in August," Chalmers told reporters.

Wednesday's report also showed:

- The largest contributor to the annual change was food and non-alcoholic beverages, up 2.9%, followed by housing, up 2%, and alcohol and tobacco.

- Electricity prices fell 5.9% in the 12 months to May, compared to a 6.5% fall in the 12 months to April.

- Rents rose 4.5% in the 12 months to May, following a 5% rise in the 12 months to April. This is the lowest annual growth in rental prices since December 2022.

--With assistance from Matthew Burgess.

(Updates markets, adds RBA rate-call changes from economists.)

The recent slowing of Australia's Monthly Consumer Price Index (CPI) lends further weight to the argument for a rate cut in July, effectively suggesting that monetary policy may soon need adjusting due to diminished inflationary pressures.

Australia's monthly Consumer Price Index (CPI) showing signs of cooling reinforces the case for a rate cut by July as policy makers seek to cushion inflationary pressures.

The ongoing moderate reduction in Australia's monthly CPI indicates further strengthening of the case for a rate cut during their July meeting, indicating an outlook that favors more accommodative monetary policies amidst this economic environment.

With Australia's monthly CPI growth cooling down, the latest data further legitimizes a rate cut in July to stem inflationary pressures.

With Australia's monthly CPI cooling down, the recent data further fortifies arguments in favor of a rate cut during July.

The cooling monthly Consumer Price Index (CPI) in Australia signals increasing momentum for a rate cut by the central bank during their July meeting, highlighting heightened concerns over inflationary pressures and economic slowdown.

Australia's monthly CPI cooling suggests further evidence in favor of a rate cut at the July meeting to stabilize economic growth and mitigate inflationary pressures.

The recent cooling of Australia's monthly CPI data reinforces the case for a rate cut in July, as it further suggests modest inflationary pressure and signals potential room to stimulate economic growth.

The cooling of Australia's monthly CPI data reinforces the argument for a rate cut in July, as policymakers grapple with managing inflationary pressures amid economic uncertainty.

With the Australian monthly CPI cooling down recently, reinforcing previous data trends that support a rate cut in July.

Australian's monthly Consumer Price Index (CPI) data cooling down furthers reinforces the case for a rate cut in July, reflecting potential easing measures to counteract inflationary pressures.

![Isothermal Bags Containers Market [2028]: Top Trends, Size, and Competitive Intelligence - TechSci Research](https://antiochtenn.com/zb_users/upload/2025/07/20250719012446175285948669203.jpg)