Aon Unveils AI-Powered Broker Copilot: Enhancing Insurance Placement and Market Impact

Aon plc (AON) has taken a strategic step toward embracing digital innovation by introducing an AI-driven platform, Aon Broker Copilot. This platform is designed to simplify and enhance the insurance placement process, merging artificial intelligence with data analytics to provide quicker, smarter, and more insightful insurance solutions.

The Aon Broker Copilot acts as a helpful digital assistant for brokers, allowing them to leverage real-time data, predictive analytics, and cutting-edge automation. This tool merges proprietary data with market insights to provide customized risk solutions, streamline manual tasks, and improve client outcomes. The Copilot system gathers and organizes data from every client submission, including any quotes that aren't utilized.

The introduction of this tool perfectly illustrates the firm's 3x3 Plan in action – an ambitious strategy aimed at enhancing client service and speeding up innovation. With a hefty $1 billion investment backing it, this plan highlights Aon's dedication to integrating AI and data-driven insights into every aspect of its operations.

The company first rolled out its Broker Copilot with the U.S. National Property team and the London Global Broking Centre Property team. This approach provides Aon with the chance to improve the platform in high-impact markets before expanding its reach to other business lines and regions.

This launch marks a significant turning point in the broking industry. Integrating structured data and AI at the decision-making stage can enhance the accuracy and speed of placement strategies, giving AON a competitive edge in risk advisory services.

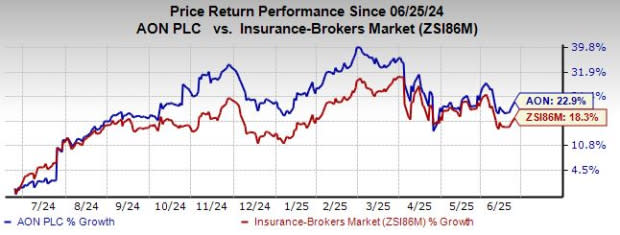

AON Stock's Price Performance

Over the past year, AON shares have gained 22.9% compared with the industry's rise of 18.3%.

AON's Zacks Rank & Key Picks

AON currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader finance space are Horace Mann Educators Corp (HMN), Heritage Insurance Holdings Inc. (HRTG), and EverQuote Inc (EVER), each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today's Zacks #1 Rank stocks here.

Horace Mann Educators: The Zacks Consensus Estimate for Horace Mann Educators' current-year earnings of $4.01 per share has witnessed two upward revisions in the past 60 days against none in the opposite direction. Horace Mann Educators beat earnings estimates in three of the trailing four quarters and met once, with the average surprise being 24.1%. The consensus estimate for current-year revenues is pegged at $1.7 billion, implying 6.6% year-over-year growth.

Heritage Insurance: The Zacks Consensus Estimate for Heritage Insurance's current-year earnings of $3.25 per share has witnessed two upward revisions in the past 60 days against no movement in the opposite direction. Heritage Insurance beat earnings estimates in each of the trailing four quarters, with the average surprise being 363.2%. The consensus estimate for current-year revenues is pegged at $854.9 million, calling for 4.6% year-over-year growth.

EverQuote: The Zacks Consensus Estimate for EverQuote's current-year earnings is pegged at $1.17 per share, implying 33% year-over-year growth. EverQuote beat earnings estimates in each of the trailing four quarters, with the average surprise being 122.6%. The consensus mark for the current-year revenues is pegged at $644.1 million, calling for 28.8% year-over-year growth.

In conclusion, Aon plc's introduction of the Aon Broker Copilot is a significant step toward embracing digital innovation and enhancing client service through the integration of AI and data analytics. While AON currently holds a Zacks Rank #3, there are several other finance stocks that are currently ranked as Strong Buys, including Horace Mann Educators Corp, Heritage Insurance Holdings Inc., and EverQuote Inc.

Aon's introduction of the AI-Powered Broker Copilot represents a significant advancement in insurance placement efficiency, offering unparalleled market insight and impact with precision analytics backed by artificial intelligence.

Aon's AI-driven Broker Copilot represents a pioneering leap in enhancing insurance placement process efficiency and market impact, solidifying the company’stailored solutions at leveraging intelligent technologies for financial security.

The newly introduced AI-Powered Broker Copilot by Aon promises to revolutionize insurance placement and market impact through enhanced automation, enabling a smarter approach in matching clients' needs with the most optimal coverage options.

The unveiling of Aon's AI-Powered Broker Copilot marks a significant leap forward in insurance placement efficiency and market impact, poised to revolutionize how policyholders receive tailored coverage through enhanced automation.

The launch of Aon's AI-Powered Broker Copilot marks a significant leap forward in enhancing insurance placement efficiency and impact, tailoring solutions for clients amidst an increasingly competitive market landscape.

Aon's AI-Powered Broker Copilot unveiled today marks a landmark in the insurance industry, significantly enhancing placement strategies and market impact.