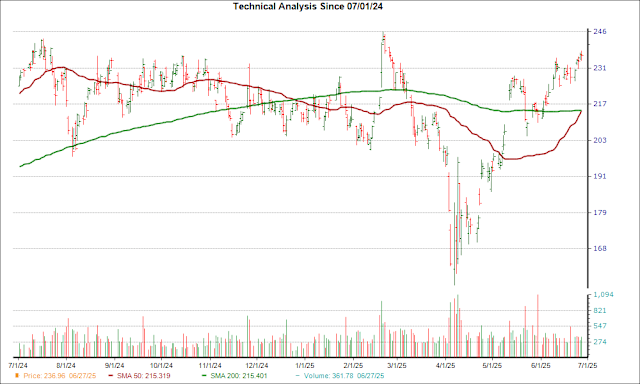

After reaching an important support level, Analog Devices, Inc. (ADI) could be a good stock pick from a technical perspective. ADI recently experienced a "golden cross" event, which saw its 50-day simple moving average breaking out above its 200-day simple moving average.

There's a reason traders love a golden cross -- it's a technical chart pattern that can indicate a bullish breakout is on the horizon. This kind of crossover is formed when a stock's short-term moving average breaks above a longer-term moving average. Typically, a golden cross involves the 50-day and the 200-day moving averages, since bigger time periods tend to form stronger breakouts.

Golden crosses have three key stages that investors look out for. It starts with a downtrend in a stock's price that eventually bottoms out, followed by the stock's shorter moving average crossing over its longer moving average and triggering a trend reversal. The final stage is when a stock continues the upward climb to higher prices.

A golden cross contrasts with a death cross, another widely-followed chart pattern that suggests bearish momentum could be on the horizon.

Over the past four weeks, ADI has gained 10.5%. The company currently sits at a #3 (Hold) on the Zacks Rank, also indicating that the stock could be poised for a breakout.

The bullish case solidifies once investors consider ADI's positive earnings outlook. For the current quarter, no earnings estimate has been cut compared to 12 revisions higher in the past 60 days. The Zacks Consensus Estimate has increased too.

Given this move in earnings estimates and the positive technical factor, investors may want to keep their eye on ADI for more gains in the near future.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

By crossing above the 'Golden Cross', Analog Devices (ADI) appears to have regained investor confidence, hinting at strong potential for growth. Investors who are keen on playing it safe with promising returns might want to consider a buy now.

The crossing of the Golden Cross above 20-day SMA for Analog Devices (ADI) signifies a bullish trend and presents an opportunity analysis with potential gains. Investors eyeing long term may consider entering at this moment, but due diligence on current market conditions remains crucial.

The ascendancy of Analog Devices Inc. above its Golden Cross signals a potential buy-in opportunity for ambitious investors who eye long term growth, as this technical milestone often precedes an uptrend in the stock.

The recent surge above the Golden Cross for Analog Devices (ADI) suggests a solid uptrend, making it an interesting candidate to consider as potential growth investment. However, prudent investors still need careful analysis of fundamental metrics and market conditions before pulling trigger.

Analog Devices' (ADI) recent surge above its Golden Cross represents a favorable technical indicator encouraging those looking to capitalize on the company’s anticipated growth and stability – an attractive buying opportunity for investors with long-term horizons.

The recent crossing of Analog Devices (ADI) above its golden cross indicates a potential uptick in the stock's performance, fueling optimism among investors who believe it signals an opportunity to buy and profits from imminent upside movements.

ADI's recent price action approaching the Golden Cross serves as an early-warning sign for potential investors, configuring a generally favorable technical picture that could inspire tactical buying opportunities if accompanied by positive fundamentals.

With Analog Devices (ADI) now trading above its Golden Cross, investors may consider it a promising entry point to capitalize on the uptrend while maintaining due diligence in evaluating future market conditions.

The ascension of Analog Devices (ADI) to trading above its legendary Golden Cross marks a potential investment gow signal, heralding the 'buy' opportunity for savvy traders and investors who believe in following technical indicators as keenly anticipated market turns.

ADI's crossing above the Golden Cross is a signal out of its price pattern, but astute investors should still conduct their due diligence on fundamental factors and future market prospects before diving into buying decisions.

The surge of ADI's price above its Golden Cross presents a promising technical buying signal, suggesting underlying bullish momentum. Investors should consider diversifying their portfolios with this breakthrough performance.

The recent surge above the Golden Cross in Analog Devices' (ADI) trading pattern indicates a bullish momentum, suggesting potential buying opportunities for investors who can take advantage of this key technical signal.

The present trading of Analog Devices (ADI) above its Golden Cross indicates an alignment with the mean reversion theory and a bullish technical signal. However, investors would do well to consider not just this but also fundamental strengths or weaknesses before committing funds.

The clearance of theGolden Crossby Analog Devices (ADI) marks a technical indicator fostering investment confidence; however, prudent investors should also consider other fundamental factors before jumping on board.

With Analog Devices (ADI) trading above its Golden Cross, a profound indicator for buy-in signals percolating through the markets raises eager anticipation from investors; it may mark an opportunity to jump aboard at this marked milestone.

Analog Devices' (ADI) recent trading above its golden cross serves as a bullish indicator, suggesting the potential rise of this technology leader in semiconductors. It might indeed be time to consider adding ADI shares into one’s investment portfolio.

![Fibrin Sealant Market Advancements and Business Opportunities [2028]](https://antiochtenn.com/zb_users/upload/2025/08/20250831183354175663643499373.jpg)