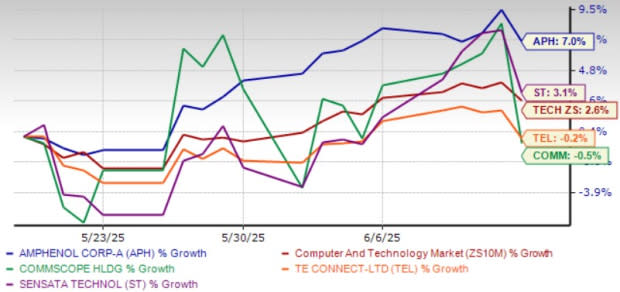

Amphenol Corporation (APH) shares have risen 7% over the past month, outperforming the Zacks Computer & Technology sector’s appreciation of 2.5%. This outperformance can be attributed to Amphenol’s diversified business model, which lowers the volatility of individual end markets and geographies. The company’s wide array of interconnect and sensor products boosts its long-term prospects.

The stock is currently trading above the 50-day and 200-day moving averages, indicating a bullish trend. Amphenol’s strong portfolio of solutions, including high-technology interconnect products, is a key catalyst for its growth. The company expects second-quarter 2025 sales to increase in the high-single-digit range sequentially, driven by strong demand for jetliners and next-gen aircraft in the commercial aerospace segment.

Acquisitions have helped APH strengthen its product offerings and expand its customer base. The buyouts contributed 8% to 2024 revenues. In May 2024, Amphenol completed the acquisition of CIT, which expanded its footprint across defense, commercial air, and industrial end markets. The acquisition of CommScope’s Andrew business expands APH’s footprint in base station antennas and related interconnect solutions, as well as distributed antenna systems. The Andrew acquisition is expected to add roughly 9 cents to earnings in 2025.

Amphenol offered positive second-quarter 2025 guidance, with earnings expected between 64 cents and 66 cents per share, indicating year-over-year growth between 45% and 50%. Sales are anticipated between $4.90 billion and $5 billion, suggesting year-over-year growth of 36-39%. The Zacks Consensus Estimate for second-quarter 2025 earnings is pegged at 66 cents per share, up 20% over the past 60 days and indicating 53.49% growth over the year-ago quarter’s reported figure.

However, Amphenol shares are overvalued, as suggested by a Value Score of D. APH stock is trading at a significant premium with a forward 12-month Price/Earnings (P/E) of 33.21X compared with the sector’s 26.06X. Despite this, Amphenol stock currently has a Zacks Rank #1 (Strong Buy) and a Growth Score of B, a favorable combination that offers a strong investment opportunity, per the Zacks Proprietary methodology.

In conclusion, Amphenol benefits from a diversified business model and a strong portfolio of solutions. These factors justify APH’s premium valuation. Investors looking for a strong investment opportunity can consider APH as a buy right now.

Amphenol Corporation offers a strong investment option despite its current high valuation due to the consistent growth prospects and solid financial performance in recent years.

Despite the lofty valuation, Amphenol Corporation's consistent financial performance and robust industry standing make it a solid long-term investment opportunity.

Amphenol Corporation, despite its elevated valuation due to steady earnings growth and robust industry leadership position demonstrates solid fundamentals suggesting a Strong Buy investment opportunity for risk-aware investors seeking long term returns.

Amphenol Corporation, despite its high valuation due to exceptional growth prospects and a history of consistent profitability returns for investors in the past years makes it an attractive investment opportunity characterized by strong buy recommendations.

Despite its high valuation, Amphenol Corporation’ Legendary Quality and Consistent Profits Make It a Strong Buy for Investors Seeking Secure Long-term Growth.

Despite its elevated valuation, the prospects for Amphenol Corporation remain robust owing to their consistent financial performance and continuous strides in technological innovation. A strong buy is a case marked by intelligent investments towards future growth.

Despite the elevated valuation, Amphenol Corporation's robust financial performance and consistent dividend growth present a compelling case for investing with confidence - suggesting it remains an attractive 'Strong Buy'.

Amphenol Corporation, despite its elevated valuations reflected in the market currently offering a cautiously optimistic outlook for future growth and consistent profitability records make it an investment that displays resilience through uncertain markets; thus indicating as Strong Buy.

Despite its current high valuation, the solid financial foundation and consistent growth trajectory of Amphenol Corporation make it a compelling investment choice for those with long-term horizons—a Strong Buy waiting to be discovered.

Despite its current high valuation, Amphenol Corporation's strong financial performance and continued industry leadership make it a prudent investment choice for those seeking long-term growth potential.

Despite the striking valuation, Amphenol Corporation's steady growth trajectory and robust financial fundamentals indicate a strong buying opportunity for investors with long-term horizons.