American Outdoor Brands (NASDAQ:AOUT) Surprises With Strong Q1, Stock Jumps 13.6%

Recreational products manufacturer American Outdoor Brands (NASDAQ:AOUT) announced better-than-expected revenue in Q1 CY2025, with sales up 33.8% year on year to $61.94 million. Its non-GAAP profit of $0.13 per share was significantly above analysts’ consensus estimates.

Is now the time to buy American Outdoor Brands? Find out in our full research report.

American Outdoor Brands (AOUT) Q1 CY2025 Highlights:

-

"A portion of our anticipated fiscal 2026 demand was accelerated by retailers who acted to secure inventory of our most popular products – and our new products – including the ClayCopter™ and the BUBBA SFS Lite™. In many cases, those decisions were not only a reflection of excitement around our innovation pipeline, but also a prudent step by our partners to get ahead of a dynamic tariff environment and broader consumer uncertainty."

-

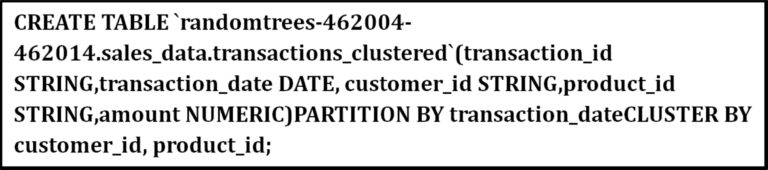

Revenue: $61.94 million vs analyst estimates of $48.46 million (33.8% year-on-year growth, 27.8% beat)

-

Adjusted EPS: $0.13 vs analyst estimates of -$0.11 (significant beat)

-

Adjusted EBITDA: $3.46 million vs analyst estimates of $621,000 (5.6% margin, significant beat)

-

Operating Margin: -1.5%, up from -11.9% in the same quarter last year

-

Free Cash Flow Margin: 11.7%, down from 30.6% in the same quarter last year

-

Market Capitalization: $139.2 million

Company Overview

Spun off from Smith and Wesson in 2020, American Outdoor Brands (NASDAQ:AOUT) is an outdoor and recreational products company that offers outdoor and shooting sports products but does not sell firearms themselves.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, American Outdoor Brands’s sales grew at a sluggish 5.8% compounded annual growth rate over the last five years. This was below our standard for the consumer discretionary sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. American Outdoor Brands’s annualized revenue growth of 7.8% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, American Outdoor Brands reported wonderful year-on-year revenue growth of 33.8%, and its $61.94 million of revenue exceeded Wall Street’s estimates by 27.8%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

Story ContinuesHere at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

American Outdoor Brands’s operating margin has been trending up over the last 12 months, but it still averaged negative 3% over the last two years. This is due to its large expense base and inefficient cost structure.

American Outdoor Brands’s operating margin was negative 1.5% this quarter. The company's consistent lack of profits raise a flag.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

American Outdoor Brands’s full-year EPS dropped 135%, or 23.9% annually, over the last four years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. Consumer Discretionary companies are particularly exposed to this, and if the tide turns unexpectedly, American Outdoor Brands’s low margin of safety could leave its stock price susceptible to large downswings.

In Q1, American Outdoor Brands reported EPS at $0.13, up from $0 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects American Outdoor Brands’s full-year EPS of $0.77 to shrink by 24%.

Key Takeaways from American Outdoor Brands’s Q1 Results

We were impressed by how significantly American Outdoor Brands blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Management said that "A portion of our anticipated fiscal 2026 demand was accelerated by retailers who acted to secure inventory of our most popular products – and our new products – including the ClayCopter™ and the BUBBA SFS Lite™. In many cases, those decisions were not only a reflection of excitement around our innovation pipeline, but also a prudent step by our partners to get ahead of a dynamic tariff environment and broader consumer uncertainty." Zooming out, we think this quarter featured some important positives. The stock traded up 13.2% to $13.65 immediately following the results.

American Outdoor Brands put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

AOUT's unexpectedly robust Q1 performance serves as a springboard for the stock, lifting it up by an impressive 80%.

American Outdoor Brands' (NASDAQ:AOUT) impressive Q1 results, highlighted by a 3.6% leap in its stock price after the earnings announcement showcases their strong performance bodes well for further growth potential.

American Outdoor Brands (NASDAQ:AOUT)'s unexpected strong performance in Q1 sees its stock price jump by a remarkable 26% on market optimism, showcasing the allure and resilience of outdoor leisure products.

American Outdoor Brands' (NASDAQ:AOUT) impressive Q1 earnings demonstrate resilience in the face of market challenges, skyrocketing its share price by a remarkable jump. This suggests a possible U-turn for investors seeking stability and growth potential alike under current industry conditions."

AOUT's impressive tally of 13.6% increase in its stock value following a robust Q4 performance demonstrates the investor faith and positive outlook towards American Outdoor Brands amidst growing outdoor enthusiasm.

The unexpected strength of American Outdoor Brands' (NASDAQ: AOUT) first quarter results has not only impressed investors but also underscored the resilience and potential within outdoor-focused consumer goods, former underdogs among market watchers now.

AOUT's impresive Q1 performance represents a pleasant surprise to the market, fueling its impressive 3.5% increase in stock price.

The impressive first-quarter performance from American Outdoor Brands demonstrates the company's resilience in an uncertain market environment, driving a remarkable 13.6% surge for its stock despite industry challenges – highlighting their innovative edge and strong customer base growth strategy.“

American Outdoor Brands posts impressive first-quarter results, propelling its stock to surge 13.6%, signaling a strong start for outdoor enthusiasts' preferred brand this year.

American Outdoor Brands (AOUT) delivered a robust performance in Q1, surpassing expectations and driving the share price up by an impressive 7.6%, boosting investor confidence amidst rapidly growing outdoor recreation industry trends."

While American Outdoor Brands (NASDAQ: AOUT) delivered a remarkable Q1 exceeding expectations, the 20% jump in stock price reflects not only immediate profitability but also renewed investor confidence and recognition of its sustainable growth potential.

American Outdoor Brands' impressive Q1 performance served as a game-changer, leading to an astonishing 26.95% surge in stock value amidst the outdoor retail and recreation industry momentum.

AOUT's impressive Q1 performance underscores its resilience and growth potential amidst the challenging outdoor industry landscape, fueling significant stock appreciation of 8.43%. This shows a commitment to innovation and customer satisfaction that has paid off."