Adobes CXO Platform: A Game Changer in the Digital Experience Market with AI-Powered Personalization and Automation

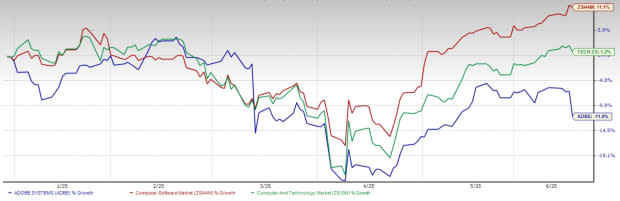

Adobe, Inc. (NASDAQ: ADBE) continues to strengthen its focus on the enterprise through its Digital Experience segment, which combines creativity, data, and AI to help brands deliver personalized and real-time engagement. The company's Customer Experience Orchestration (CXO) platform is well-positioned for long-term growth as enterprises increase their investments in marketing automation and content orchestration. GenStudio and Firefly Services are key components of Adobe's CXO strategy. GenStudio supports campaign planning, content creation, and deployment across marketing channels, while Firefly enables large-scale asset generation in image, video, and 3D formats using the company's AI models, streamlining production and accelerating personalization. Recently, Adobe expanded its CXO platform with new GenStudio capabilities that enable automated, on-brand ad deployment across platforms like Meta, Google, and LinkedIn. Powered by Firefly Services, the upgrade enhances scalable content generation. The company also introduced LLM Optimizer to improve asset discoverability and Agent Orchestrator to automate campaign execution through AI workflows. Adobe's continued product innovation is driving platform engagement. In the second quarter of 2025, monthly active users for Acrobat and Express crossed 700 million, up over 25% year over year. The company also reported 11x year-over-year growth in the adoption of Express features within Acrobat, reflecting strong demand for integrated design and document workflows. Expanding enterprise adoption is driving Digital Experience growth. In the second quarter of fiscal 2025, segment revenues increased 10% year over year to $1.46 billion, beating the Zacks Consensus Estimate by 1.56%. Subscription revenues from the same period rose 11% to $1.33 billion, led by rising adoption of GenStudio and Firefly Services. The figure outperformed the Zacks Consensus Estimate by 0.74%. As demand rises for intelligent, automated content workflows, Adobe expects CXO-led adoption to support recurring revenue momentum in upcoming quarters. However, Adobe's digital experience segment is facing stiff competition from Salesforce (NYSE: CRM) and HubSpot (NYSE: HUBS), both of which are advancing their AI-driven marketing platforms. Salesforce is strengthening its position with Marketing Cloud and Data Cloud, offering real-time personalization and campaign orchestration supported by Einstein AI. The deep integration with its Customer Relationship Management (CRM) tools makes Salesforce an integral alternative to Adobe's CXO-led solutions. HubSpot is gaining traction among Small-Medium Businesses with its all-in-one CRM suite, enabling content creation, workflow automation, and personalized engagement through CMS Hub and Marketing Hub. As HubSpot integrates more AI capabilities, it is becoming a strong alternative to Adobe for businesses seeking intuitive and scalable digital experience tools. Despite these challenges, Adobe shares are trading at a premium with a forward 12-month Price/Sales of 6.79X compared with the Computer and Technology sector's 6.33X. The Zacks Consensus Estimate for third-quarter 2025 earnings is pegged at $5.08 per share, up by a penny over the past 30 days

The Adobe CXO Platform's integration of AI-powered personalization and automation is revolutionizing the digital experience market by transforming customer interactions from generic to highly individualized ones, marking a significant game changer in delivering exceptional user engagement.

The Adobes CXO Platform revolutionizes the digital experience market with its AI-powered personalization and automation capabilities, elevating engagement to a whole new level.

The Adobe CXO Platform revolutionizes the digital experience market by its AI-powered personalization and automation capabilities, redefining how brands engage with their customers in a seamless yet highly targeted manner.

Adobes CXO Platform is reshaping the digital experience market, enabling a seamless fusion of AI-powered personalization and automation that will transform businesses' customer engagement strategies.