Accounts Payable vs. Receivable: Startup Guide

Learn the basics of accounts payable and receivable. Perfect for startups using accounting and bookkeeping services to manage cash flow.

At Ceptrum, we know that mastering AP and AR is what separates thriving startups from those struggling with cash flow.

In the dynamic world of startup finance, understanding the distinction between accounts payable and accounts receivable is more than bookkeeping trivia it’s a foundation for sustainable growth. Whether you're a founder or managing financial operations, choosing the right accounting and bookkeeping service for startups can help streamline these crucial processes.

This guide breaks down these critical accounting concepts with actionable insights for your business.

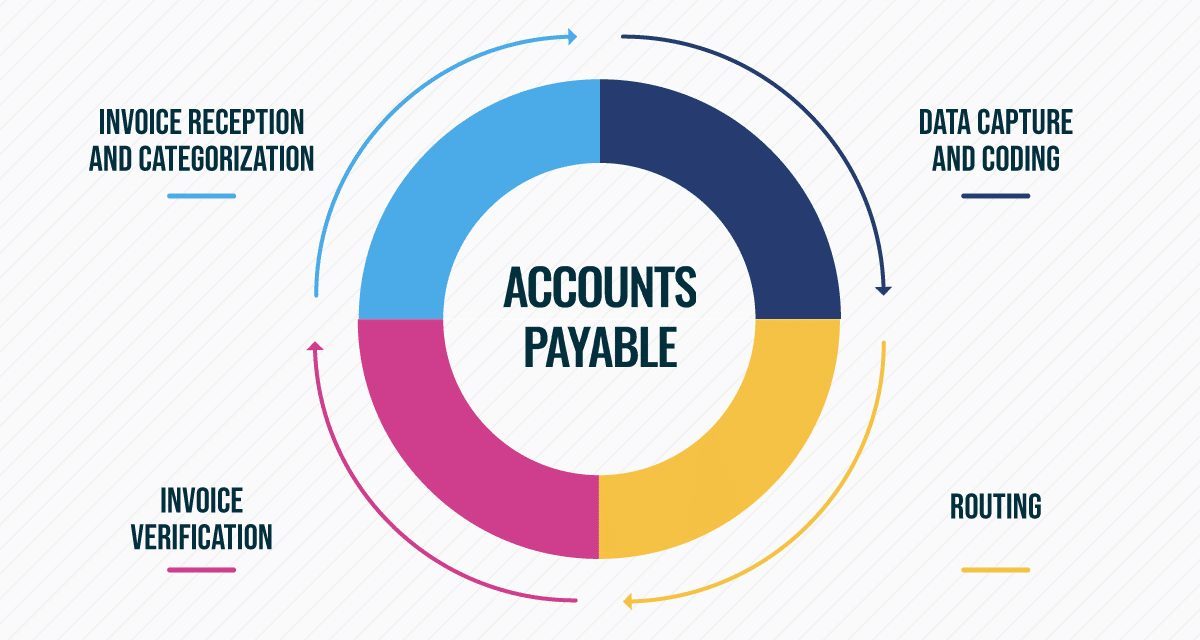

What Is Accounts Payable?

Accounts payable (AP) refers to the money a business owes its vendors or suppliers. It reflects short-term liabilities and is a key part of cash flow management. For instance, a startup receiving inventory or services on credit records those as AP until they're paid.

Reliable small company bookkeeping services play a vital role in managing AP accurately—ensuring bills are paid on time without harming cash reserves.

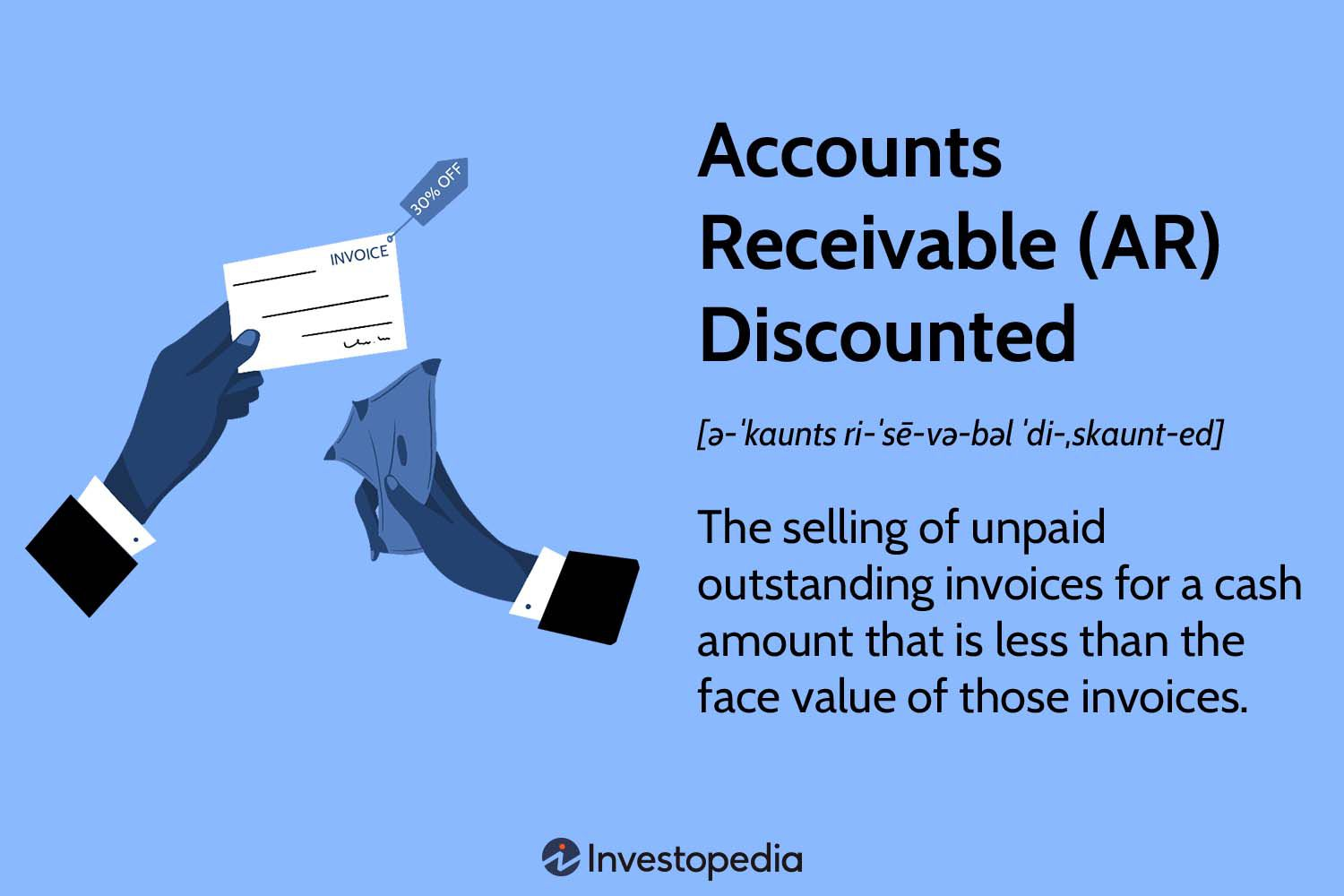

What Is Accounts Receivable?

Accounts receivable (AR), on the other hand, represents money owed to the business—typically from clients or customers. Efficient tracking of receivables ensures that the business maintains liquidity and has a clear picture of income.

Many startup accounting services offer tools and dashboards that make AR management easier, reducing the risk of overdue payments and enhancing financial forecasting.

How Accounting Tools Bridge the Gap

Modern platforms like Xero accounting software and QuickBooks for small business provide real-time AP/AR dashboards. These tools enable startups to sync invoicing, payment schedules, and vendor management into one unified system—saving time and reducing errors.

Using cloud-based tools supported by a reliable accounting for startups strategy ensures these processes are monitored, updated, and automatically reconciled with financial statements.

Why It Matters for Startups

Understanding AP and AR isn’t just for accountants founders benefit too. Expert tax services for startups often start by reviewing payables and receivables to uncover cash flow inefficiencies and identify potential write-offs or tax savings.

Choosing an efficient accounting and bookkeeping service for startups means your finances aren’t just compliant they’re working in your favor, powering strategic growth.

Why Startups Must Master Both

Cash Flow Survival - 82% of failures stem from poor cash management

Investor Confidence - Clean AP/AR records simplify due diligence

Tax Optimization - Impacts deductions and income reportingSupplier/Client Relationships - Builds trust through reliability

Ceptrum's Complete AP/AR Solution

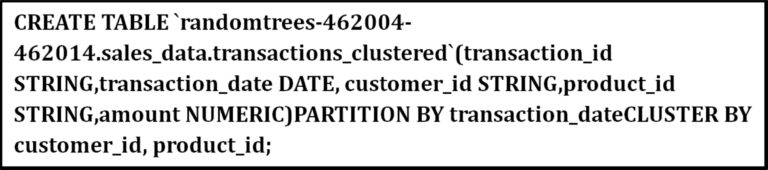

Setup: Configure your Xero accounting software or QuickBooks

Process: Automate invoices and bill payments

Monitor: Real-time AP/AR dashboards

Optimize: Monthly strategy sessions

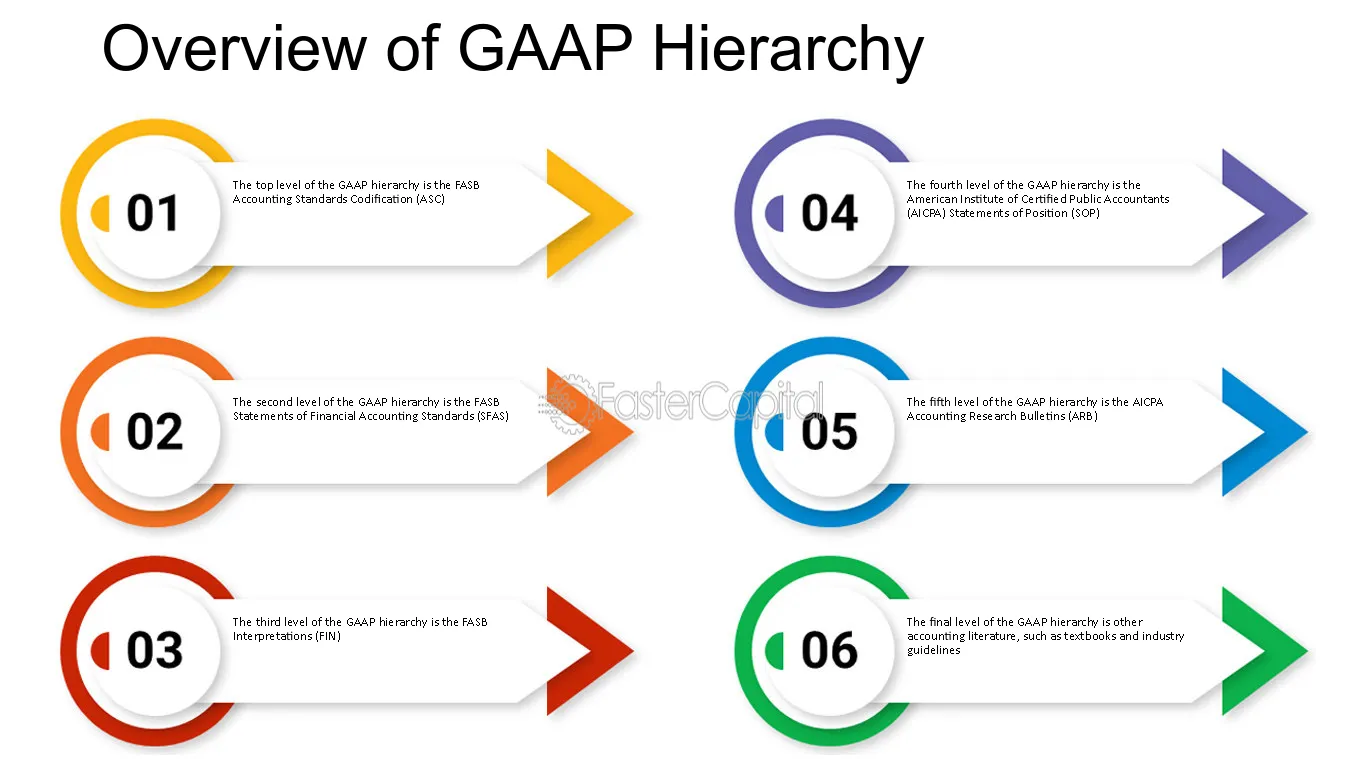

Tax Implications

✔ AP: Record when goods/services received (accrual) or paid (cash)

✔ AR: Taxable when billed (accrual) or received (cash)

✔ Write-offs: Bad debt deductions require proper documentation

Ceptrum tax services for startups ensure proper treatment of both.

Final Thoughts

Mastering accounts payable and receivable management gives startups a clearer path to financial success. With the right support—be it startup accounting services, Xero accounting software, or QuickBooks for small business—founders gain more control, better insights, and ultimately, more confidence in their business’s future.

With Ceptrum accounting for startups expertise, you'll gain the clarity and confidence to make smarter financial decisions. Let's build your financial future together!

With its clear breakdown of Accounts Payable vs. Receivable, this Startup Guide provides a practical and concise roadmap for new entrepreneurs to manage their finances effectively from the very beginning.

This comprehensive startup guide on 'Accounts Payable vs. Receivable: A Comprehensive Insight' provides a clear explanation of the differences, importance for small businesses and practical tips to effectively manage each aspect.

This start-up guide effectively explains the crucial difference between Accounts Payable and Receivable, providing valuable insights for fledgling businesses looking to manage their finances more efficiently.

As a rookie in the startup world, this guide has been incredibly helpful to differentiate Accounts Payable from Receivable. The clear explanations and practical tips make it an essential read for anyone navigating financial management during their business' growth phase.”

This guide, 'Accounts Payable vs. Receivable: A Startup Guide,' provides an engaging and comprehensive introduction for new entrepreneurs on the nuances of managing a business's financial inflow (receivables) versus outflow (payable), crucial to maintaining cash flow health.

Navigating the intricacies of Accounts Payable vs. Receivable with 'AccountsPayablesVsReceivabicles Startup Guide' is a crucial first step for any startup owner looking to maintain financial equilibrium and stay on top.

Navigating the complexities of Accounts Payable versus Receivable in a startup can be daunting, but this guide offers valuable insights and practical advice for newcomers to ensure financial operations run smoothly.

This startup guide on 'Accounts Payable vs. Receivable' is a must-read for budding entrepreneurs, providing an invaluable insight into cash flow management and ensuring financial health of growing businesses.

The Startup Guide on 'Accounts Payable vs. Receivable' effectively illuminates the crucial distinctions between这两者, fostering a better understanding for fledgling entrepreneurs to manage their finances and ensure smooth operations.

This comprehensive startup guide brilliantly compares and contrasts Account Payable with Receivable, offering practical insights for aspiring business owners to manage cash flow effectively while navigating the complexities of financial transactions.

This start-up guide effectively clarifies the crucial differences between accounts payable and receivable, providing valuable insights for entrepreneurs on managing cash flow in their businesses.

As a beginner navigating the financial waters of starting up, this guide on Accounts Payable vs. Receivable provides an indispensable primer for understanding cash flow management essential to any entrepreneurial journey.

This comprehensive guide effectively differentiates accounts payable from receivable, offering an invaluable resource for startup founders to understand the critical financial aspects of managing cash flow and debt.

This comprehensive guide on Accounts Payable vs. Receivable provides an invaluable starting point for entrepreneurs and small business owners to understand the nuances of managing financial transactions, ensuring they stay afloat by minimizing cash flow gaps.