Riding the AI Infrastructure Boom: Vertiv and Eaton as Key Players in Data Center Growth

Artificial intelligence (AI) has been a hot topic in the market for some time now, with investors seeking ways to gain exposure to this technology. The AI theme has been one of the strongest in recent years, with many stocks benefiting from the frenzy. For those interested in gaining exposure to AI through the data center angle, two stocks to consider are Vertiv (VRT) and Eaton (ETN).

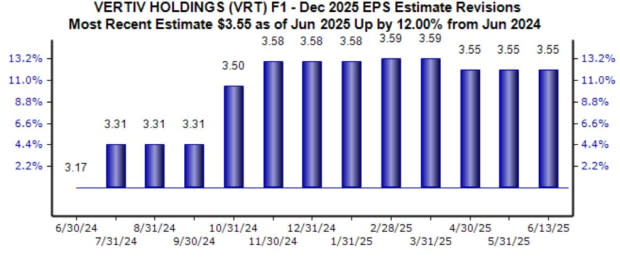

Vertiv is a company that provides services for data centers, communication networks, and commercial and industrial facilities with a portfolio of power, cooling, and IT infrastructure solutions and services. Analysts have increased their EPS expectations over the past year due to bullish commentary, with the current Zacks Consensus EPS estimate suggesting 25% YoY growth. Vertiv is expected to see 18% YoY sales growth in its current fiscal year, with double-digit percentage sales growth reported in each of its past four quarters. The company has also upped its current year sales guidance following the release of its Q1 results, which showed 13% YoY growth and 21% sequential growth in orders.

Eaton is an intelligent power management company that provides products for the data center, utility, industrial, commercial, machine building, residential, aerospace, and mobility markets. The company's latest set of results was highly positive, with record Q1 adjusted EPS of $2.72 (up 13% YoY), record Q1 sales of $6.4 billion (up 7% YoY), and record segment margins of 23.9% (80 bp increase YoY). ETN shares also offer a great opportunity for those seeking income, with a 7% five-year annualized dividend growth rate. The company has paid a dividend on its shares every year since 1923.

Both VRT and ETN deserve consideration for those interested in the AI frenzy due to their involvement within data centers. As AI continues to be a driving force in productivity and operational efficiencies for businesses, these two companies are well-positioned to capitalize on this trend.

To stay up-to-date on the latest recommendations from Zacks Investment Research, you can download their "7 Best Stocks for the Next 30 Days" report today.

Vertiv and Eaton's pivotal role in harnessing the AI infrastructure boom highlights their strategic vitality for nurturing a robust data center ecosystem, paving new avenues of growth through tailored solutions that cater to evolving needs.

In the thriving AI infrastructure era, Vertiv and Eaton serve as indispensable enablers for data center growth by delivering innovative solutions that power through technology's transformation.

In the ascendant era of AI infrastructure, Vertiv and Eaton are pivotal players driving data center growth by their expertise in delivering robust yet efficient solutions that propel technological advancements.

The quest for sustained growth amidst the AI infrastructure boom sees Vertiv and Eaton emerging as pivotal players in driving data center expansion, ensuring reliable platforms that power digitization at scale.

In the surging wave of AI infrastructure growth, Vertiv and Eaton emerge as pivotal contributors to data center expansion through their combined technological prowess that ensures energy efficiency alongside scalability.

With their strategic contributions to the advancement of AI-driven infrastructure, Vertiv and Eaton emerge as pivotal enablers in propelling data center growth during this boom period.

As the AI infrastructure market booms, Vertiv and Eaton's contribution to data center growth underscores their pivotal roles in powering this digital revolution through advanced cooling solutions.

With Vertiv and Eaton at the forefront as key enablers of AI infrastructure growth, they clearly embody a new wave in data center innovation by leveraging cutting-edge technology to ride on this massive boom.

Vertiv and Eaton's pivotal role in propelling the growth of data centers during AI infrastructure boom underscores their strategic importance for navigating through technological transformations with resilience.

In the surge of AI infrastructure development, Vertiv and Eaton emerge as pivotal stakeholders propelling data center growth through their innovative solutions that seamlessly fuse technology with sustainability.

Vertiv and Eaton's pivotal role in driving the expansion of data centers amidst the AI infrastructure boom underscores their commitment to transforming digital landscapes through cutting-edge solutions.

Undoubtedly, Vertiv and Eaton are the cornerstone collaborators navigating efficiently in a thriving AI infrastructure landscape for data center progression amidst swift technological advancements.他们的合作在充分运用先进技术推进数据中心成长方面无疑树立了典范。