What happens on social media does not stay on social media. Single Tweets and community conversations impact the real world—from influencing what film gets honored at the Oscars, to causing a 2500% increase in app downloads. But its ability to influence markets is what makes social media for investor relations so crucial.

The impact of social media on the world is here to stay. Investor relations leaders have an opportunity to reshape their engagement strategy to harness this powerful communications channel. From the path to the public market, to publishing investor messaging and understanding perception, let’s explore social media ROI and how it can enhance investor relations strategies.

The benefits of using social media for investor relations

According to recent data, 75% of investors now use social media to inform investment decisions. The role of investor relations is changing—and requires collaboration with more internal stakeholders than ever before.

“Social media has become a key platform for investor relations professionals to gauge important conversations around their company and the broader market,” Sprout Social’s Corporate Communications Strategist Abigail Schmitt tells us. “Particularly in recent years, platforms like Reddit and Twitter have become popular destinations for retail and institutional investors to discuss and analyze market trends.”

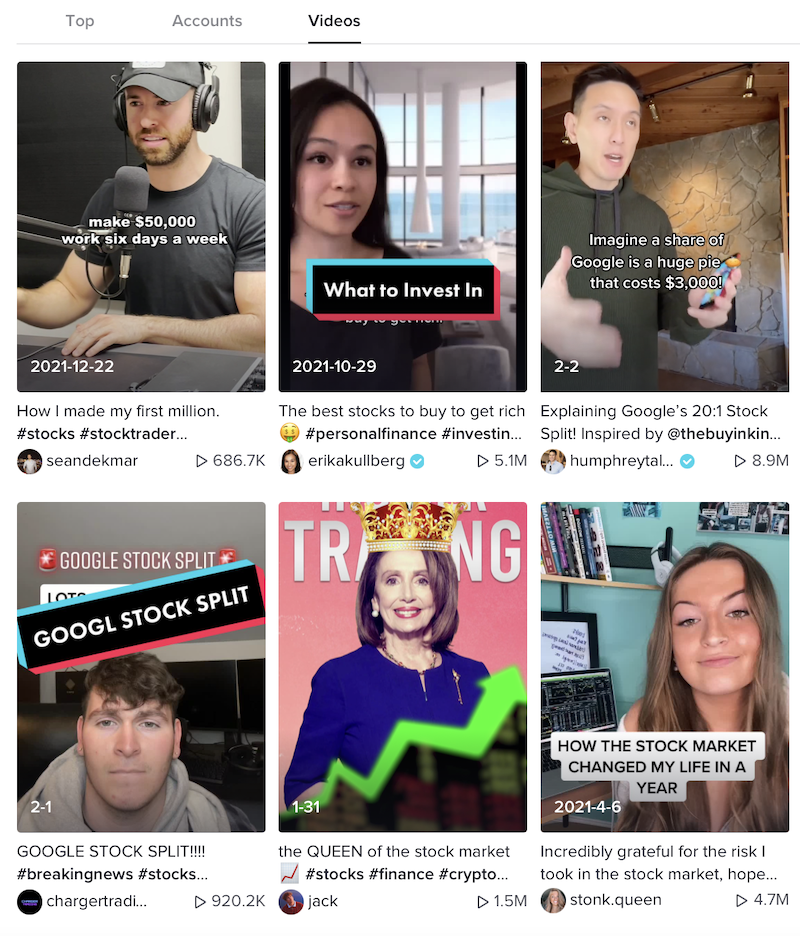

From an education and connection standpoint, it is critical to ensure that the right content, facts and investor messaging come directly from the company for investors to find on social. Investors large and small are increasingly using social to research new investment ideas—on TikTok alone, the #stocks topic has amassed 5.2 billion views. And Business Insider reports that membership on the subreddit r/FinancialPlanning saw 87% growth between June 2020 and June 2021.

IR departments have an opportunity to reduce friction from this process and empower decision making with a proactive social content strategy.

“Dating back just ten years ago, investor presentations, facts and investment information was gated to the world’s largest institutional money managers. This information is now democratized on social to empower all investors to make the best possible decisions with the most relevant information,” says Sprout Social’s Head of Investor Relations and Corporate Development Jason Rechel. “At the same time, IR leaders now understand the power that a group of vocal investors on social can have on an individual stock price.”

Social also has billions of data points that can be harnessed in real time to help keep IR leaders informed about corporate brand health, employer brand health, competitive changes, consumer product sentiment, investor sentiment and more. Harnessed in the right way, social media efforts' ROI fosters results beyond just financial gains. The insights from social can help senior management stay in front of potential crises and manage investor Q&A appropriately.

Now that you know the why, here’s how you can use social media to empower your investor relations team and strategy.

Connect with future investors and find your influencers

The pandemic spurred a new wave of retail investors. A Charles Schwab survey revealed that 15% of current retail investors started investing in 2020. And members of Gen Z are more invested in the stock market than financial assets—including cryptocurrency.

Social media has made investment education more accessible. Financial influencers on 'Stock Tok' amass thousands of followers. And in a new survey, 41% of 18-24 year old investors said they turn to social media platforms like Reddit, Instagram and TikTok to learn.

“For IR leaders, it is table stakes to have a social media strategy,” Jason tells us. “Understanding that your audience now actively seeks out investment information on social means that IR leaders need to proactively meet this audience on social with relevant financial information, KPIs and messaging to democratize the investment process.”

If you’re not in the same channel as future investors, you’re missing the chance to connect with a new audience. Use social media to listen to the conversations your future investors may be having, understand what motivates them and to see what content resonates with them.

Monitor conversations and sentiment

Imagine being able to get wind of market volatility months before it comes to a head. It doesn’t take psychic powers—using social listening can help you stay informed about developments and new importation on social, which can happen months before impacting a stock price.

When GameStop’s stocks infamously skyrocketed in early 2021, Nasdaq used social media to match conversations with unusual trading activity. This is social listening in action—tuning into digital conversations to understand what’s being said about a topic and how people feel about it.

"We definitely have seen a significant increase in retail participation in the market throughout the year," says @adenatfriedman. "We do have technology that evaluates social media chatter'and match that up against unusual trading activity'we will potentially halt that stock." pic.twitter.com/UWvg53YFI6

— Squawk Box (@SquawkCNBC) January 27, 2021

This comprehensive guide offers a concise and practical pathway for beginners in understanding social media's role within investor relations, making it an indispensable resource to enhance communication with stakeholders.

This comprehensive guide offers insightful tips for investors on leveraging social media platforms to solidify their presence and engage with audiences, making it an invaluable resource particularly for newcomers navigating the ever-evolving landscape of investor relations.

This comprehensive guide effectively navigates the intricacies of social media for investor relations, making it a must-read starting point for beginners seeking to strengthen their corporate communication strategies through digital channels.

This beginner's guide to social media for investor relations offers practical advice and strategies that enable financial professionals to engage with stakeholders effectively, promoting transparency while enhancing trust. A must-read resource.