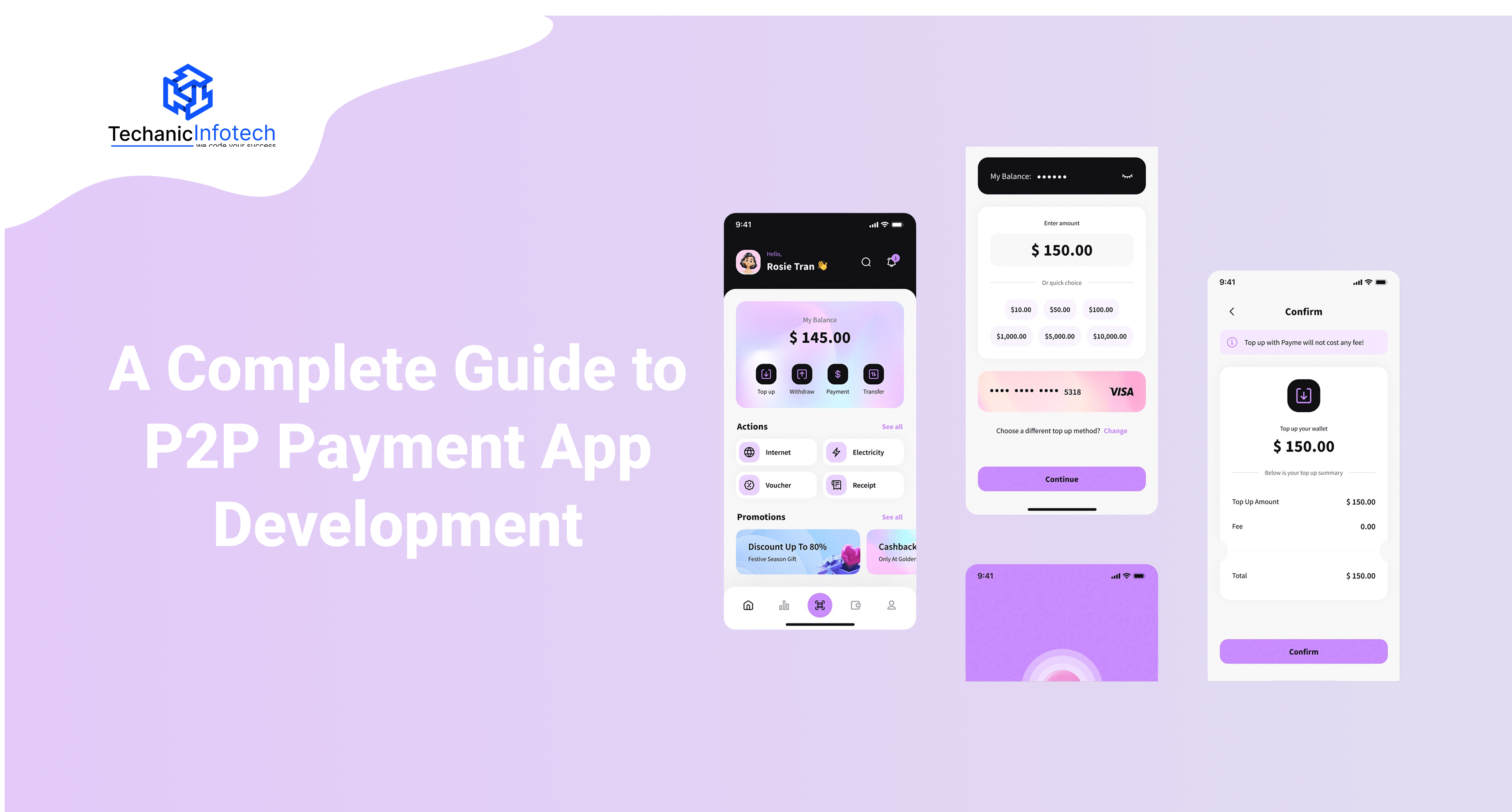

Building a Successful P2P Payment App: A Comprehensive Guide to Development

In today's digital age, peer-to-peer (P2P) payment apps have become an integral part of our daily lives. From splitting bills with friends to sending money for concert tickets, these apps have made financial transactions faster and more convenient. If you're considering developing a P2P payment app, this guide will take you through the fundamentals, development process, and future trends to help you create a successful app.

What is a P2P Payment App?

A P2P payment app allows users to make payments directly from their mobile phones to another user's mobile phone without the need for cash, cards, or traditional banking services in certain circumstances. These apps enable users to link their bank accounts or digital wallets, allowing for quick and secure payments anywhere, at any time. Examples include Venmo, PayPal, and Cash App.

Why Invest in P2P Payment App Development?

- Huge Market Demand: The demand for quick and secure mobile payment solutions is expanding rapidly. Developing a payment app means joining a market with millions of users searching for better solutions.

- Seamless Monetization Opportunities: P2P applications provide user convenience while also serving as a revenue-generating tool. You can generate revenue through service fees, advertising, subscription models, and business partnerships.

- Competitive Differentiation: Developing a payment application specifically designed for your brand and audience enables you to differentiate yourself within the crowded digital marketplace.

- Future-Ready Fintech Integration: P2P applications integrate effectively with blockchain networks, cryptocurrency, and AI finance solutions. Developing a payment app today creates opportunities for advanced fintech integration in the future.

Steps to Build a P2P Payment App

- Define Your App’s Purpose and Audience: Determine the unique functionalities that will define your application. Will it enable informal financial exchanges among friends or small businesses? Your app might serve freelancers and support international transactions. Design user-first from the start.

- Design the Feature Set: Your app must provide instant money transfer support, connect bank accounts and save transaction history, read QR codes, and implement biometric login for security. Push notifications and in-app support enhance user experience.

- Select an Appropriate Tech Stack: Your app needs secure backend infrastructure and trustworthy APIs with a clean user interface. Choose a scalable and high-performance app tech stack.

- Design for Simplicity and Trust: Design easily understandable layouts and facilitate smooth navigation. Ensure your security badges, UX flow, and branding inform users that they are in a secure environment.

- Prioritize Security from Day One: Implement end-to-end encryption combined with multi-factor authentication and fraud detection features. Security needs to be the building block since money transactions need to be secured.

- Test, Iterate, Repeat: Begin with a beta release and keep improving based on feedback. Test your app under real-world conditions such as weak internet connectivity, older hardware, and users who find it difficult to use the interface.

- Launch and Market the App: Get your app featured in appropriate app stores while creating buzz on social media websites using launch offers and first-user incentives, and partner with finance industry influencers.

Features to Have in a Peer-to-peer Payment App

- Instant Money Transfers: Users demand real-time money transfers that avoid delays or pending status.

- Bank & Card Linking: Ensure users can connect their selected bank accounts and cards along with additional wallets.

- Transaction History: Users need to access information about their transactions along with corresponding dates. Provide filtering options and downloadable reports for budgeting and record management.

- QR Code Payments: QR codes provide a quick, secure method for money transfers during face-to-face transactions.

- Push Notifications: Notifications ensure users remain informed about each transfer, receipt, or alert.

- Biometric Authentication: Face ID, fingerprint scans, and retina recognition enable users to secure their accounts with ease.

- Split Bills Feature: Users can divide payments and complete transactions immediately, which works great for group dining, shared travel expenses, or collective subscriptions.

- In-App Chat Support: Real-time customer support through built-in chat features enhances user experience through responsiveness and dependability.

Challenges You May Face While Creating a Payment App

- Security & Fraud Prevention: Robust encryption methods coupled with biometric authentication processes, two-factor login procedures, and real-time fraud detection features are essential.

- Regulatory Compliance: Adhere rigorously to PCI DSS compliance guidelines, KYC, and AML guidelines which vary from country to country.

- Real-Time Transactions: Develop a backend system that runs with both superb speed and perfect reliability for instant payments.

- User-Friendly Interface: Ensure your app looks simple yet trustworthy with clear guides for users and transparent messages for payment failures and user drop-offs.

- Handling Multiple Integrations: Integrate bank APIs, payment gateways, identity verification services, and real-time notifications seamlessly while keeping things in sync between services demands a solid architecture and continuous testing.

- Scalability and Performance: Build a backend infrastructure tailored for high performance to reach your goal of having a P2P payment application growing from hundreds to millions of users.

Future Trends in Developing a P2P Payment App

- Cross-Border Transactions & Multi-Currency Support: Create a multi-currency P2P payment app with cheap cross-border payments to cover more users yet remain competitive in global markets.

- Fraud Detection powered by AI: Integrate AI for efficient fraud detection using real-time behavioral pattern analysis to avoid harm quickly and discerningly.

- Voice & Chat-Based Payments: Integrate voice assistants and in-app chat payment capabilities to make it easier for users.

- Blockchain & Crypto Integration: Use blockchain technology for transparency, speed, and minimal fees while providing stablecoins or crypto wallets for tech-savvy and worldwide users.

- Hyper-Personalization & Smart Insights: Provide spending reports, savings tips, and smart alerts using analytics and AI to turn your application into a specialized personal finance butler.

How Can Techanic Infotech Help in Developing a Peer-to-Peer Payment App?

Techanic Infotech is a reliable eWallet app development company that excels at creating P2P payment apps that not only function but also amaze with intuitive UI designs that users can't resist tapping to bulletproof backend systems designed for real-time transactions. Need to add AI, blockchain, or voice payments? We've got you covered! Let's create something future-ready together! 📱💰💻

This comprehensive guide provides well-researched insights and practical guidance for developing a successful P2P payment app, making it an invaluable resource that equips readers with the knowledge to navigate this rapidly evolving market efficiently.

This comprehensive guide to the development of a successful P2P payment app is an invaluable resource for anyone looking into creating user-friendly, secure and efficient digital financial platforms that can capitalize on market trends.

This comprehensive guide on developing a successful P2P payment app provides an invaluable roadmap for entrepreneurs looking to navigate the intricate landscapes of financial technology and user experience, making it a must-read resource.